Start simplifying your business spend with Alaan 🚀

Some expenses are ineligible for input VAT recovery in the UAE. Read this blog to know more.

As per the FTA guidelines, registered businesses can claim an input tax credit against VAT paid on the purchase of eligible products and services. However, there are certain expense categories where claiming input VAT is not possible, and these are classified as Non-Recoverable Input VAT in the UAE.

Understanding this concept is critical for accurate tax filing and avoiding penalties from the Federal Tax Authority (FTA). By recognising different expenses that fall under this category, you can effectively manage your cash flow and optimise your VAT claims.

This blog covers different supplies ineligible for input VAT credit, the process to handle such purchases, and answers important questions related to non-recoverable input VAT in the UAE. Keep reading to know more.

In the UAE's VAT system, registered enterprises have the option to recover the VAT paid on purchases used to make taxable supplies. This provision allows you to offset the tax paid for business purchases against the VAT charged for your sales. As a result, your overall tax burden and the amount to be remitted to the government is reduced.

However, there are certain exceptions where the VAT you have paid cannot be claimed. This can happen in two situations:

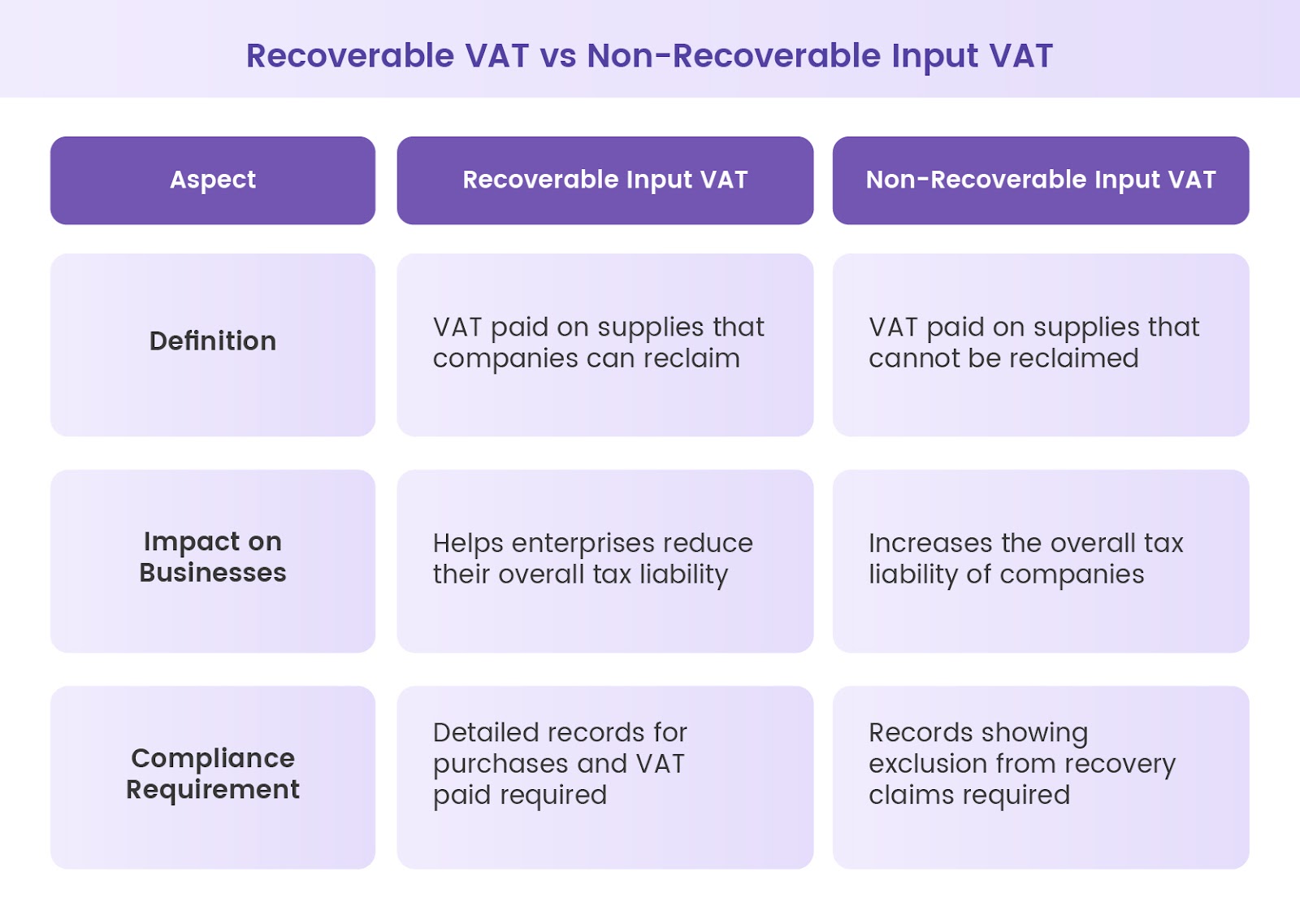

The key difference between recoverable and non-recoverable VAT lies in your ability to claim the input credit.

Recoverable VAT allows you to reduce your tax liability by claiming an input credit on your VAT return. On the other hand, non-recoverable VAT becomes part of your overall business expense and cannot be offset against your output VAT.

As per the Federal Decree Law No. (8) of 2017, certain supplies are not eligible for recoverable input tax. Here are important details related to such supplies:

According to the UAE VAT rules, taxes paid on entertainment expenses are non-recoverable. This expenditure could include extravagant meals, tickets to sports events, or fun activities for employees or clients.

The rule is also applicable to the costs linked with offering hotel accommodation services, food, and drinks that are not typically part of a business meeting. However, there are certain exceptions:

As per the UAE VAT Law, the term motor vehicle refers to a road vehicle meant for the conveyance of 10 or fewer persons, including the driver. This definition excludes vehicles like a truck, forklifts, hoists or other similar vehicles.

The VAT treatment for company vehicles depends on their usage:

There are a few exceptions where the vehicle used for your company will not be treated as available for personal use:

According to UAE VAT rules, the tax paid on goods or services purchased for use by employees, for which they have paid no charges, is not recoverable. This means that if you incur expenses for the personal benefit of employees, the VAT paid on these expenditures cannot be claimed. For instance, if you provide complementary gym memberships to your employees for their fitness needs, the VAT paid on these memberships is not recoverable.

There are exceptions to this rule. If the services or goods have been purchased to be used by employees for no charge but are directly related to the business, the VAT may be recoverable, such as:

Here are some important tips to handle non-recoverable input VAT in the UAE to ensure compliance with the FTA guidelines:

Navigating the complexities of VAT reporting and ensuring FTA compliance can be daunting. However, with Alaan's spend management solutions, you can effectively streamline your VAT reporting process, ensuring accuracy and compliance.

One of the key features of Alaan's spend management solution is the ability to automate VAT calculations. The system can be configured to apply the correct VAT rate to each purchase, and it can automatically calculate the VAT owed on each invoice. This lowers the human error risk and ensures consistency in your VAT calculations, reducing the chance of penalties from the FTA.

Alaan keeps you VAT compliant by categorising your expenses according to their VAT treatment (e.g., exempt, zero-rated, standard). This clear categorisation makes it easy to identify recoverable input VAT and non-recoverable input VAT, simplifying your VAT return preparation.

It also helps you maintain a clear audit trail of all VAT transactions and maximise your VAT reclaim opportunities. With all your invoices stored in a central location, you can easily access them for record-keeping and reclaim purposes. This eliminates the need for maintaining physical copies and simplifies the process of VAT reconciliation.

Want to understand how Alaan can ease your VAT reporting better? Connect with the experts at Alaan to know more!

Yes, depending on certain conditions. As per the FTA guidelines, VAT on catering can be reclaimed for corporate events and conferences if a fee is charged for attendance.

This means that if your company organises a conference or event and charges attendees a fee, the input VAT incurred on catering services is fully recoverable. However, if the event is free to attend, the VAT on catering becomes a non-recoverable expense for your company.

No, VAT on gifts provided to employees is not recoverable in the UAE. This includes retirement presents, long service awards, Eid presents, or rewards for other festivals or special occasions.

Even if these gifts are given to reward employees for their service, the VAT paid on these gifts cannot be reclaimed. This rule is in line with the Federal Decree-Law No. (8) of 2017 on Value Added Tax, which states that it is not possible to recover VAT that has been incurred on the purchase of goods or services to be given away to the staff.

The recovery of input VAT in the UAE should be made within the first two tax periods after the date of supply. To claim input tax, you must meet two conditions within the specific tax period:

If you plan to pay within the same tax period you receive the invoice, you can recover the input tax immediately. However, if you decide to pay later in a tax period after the invoice receipt, your input tax recovery will be pushed to that later period.

In case you miss meeting both conditions in the initial tax period. You can still recover the input tax in the very next tax period. But if you miss recovery in both the tax periods, you have to provide a voluntary disclosure. This would allow you to update the input tax reported in a VAT return for one of those two periods.

Yes, it is possible to claim input VAT on past invoices in the UAE under the following conditions.

If your company has newly registered for VAT, then you can claim VAT paid on goods and services purchased prior to the VAT registration. However, you cannot claim input VAT on invoices older than five years before your VAT registration date.