Doing business in the UAE and importing from abroad? The Federal Tax Authority (FTA) has good news for companies like yours! The apex government body introduced the Reverse Charge Mechanism (RCM) to simplify VAT for overseas suppliers, saving them the hassle of registering for VAT in the UAE.

This cabinet decision aims to align the UAE Tax Law with international standards. RCM can significantly affect your business, especially if you regularly engage in international transactions.

This blog explores RCM in the UAE and compares it to the standard Forward Charge Mechanism (FCM). We will also learn about cases in which RCM is applied and the benefits it offers. Keep reading to learn more!

Understanding RCM in the UAE VAT

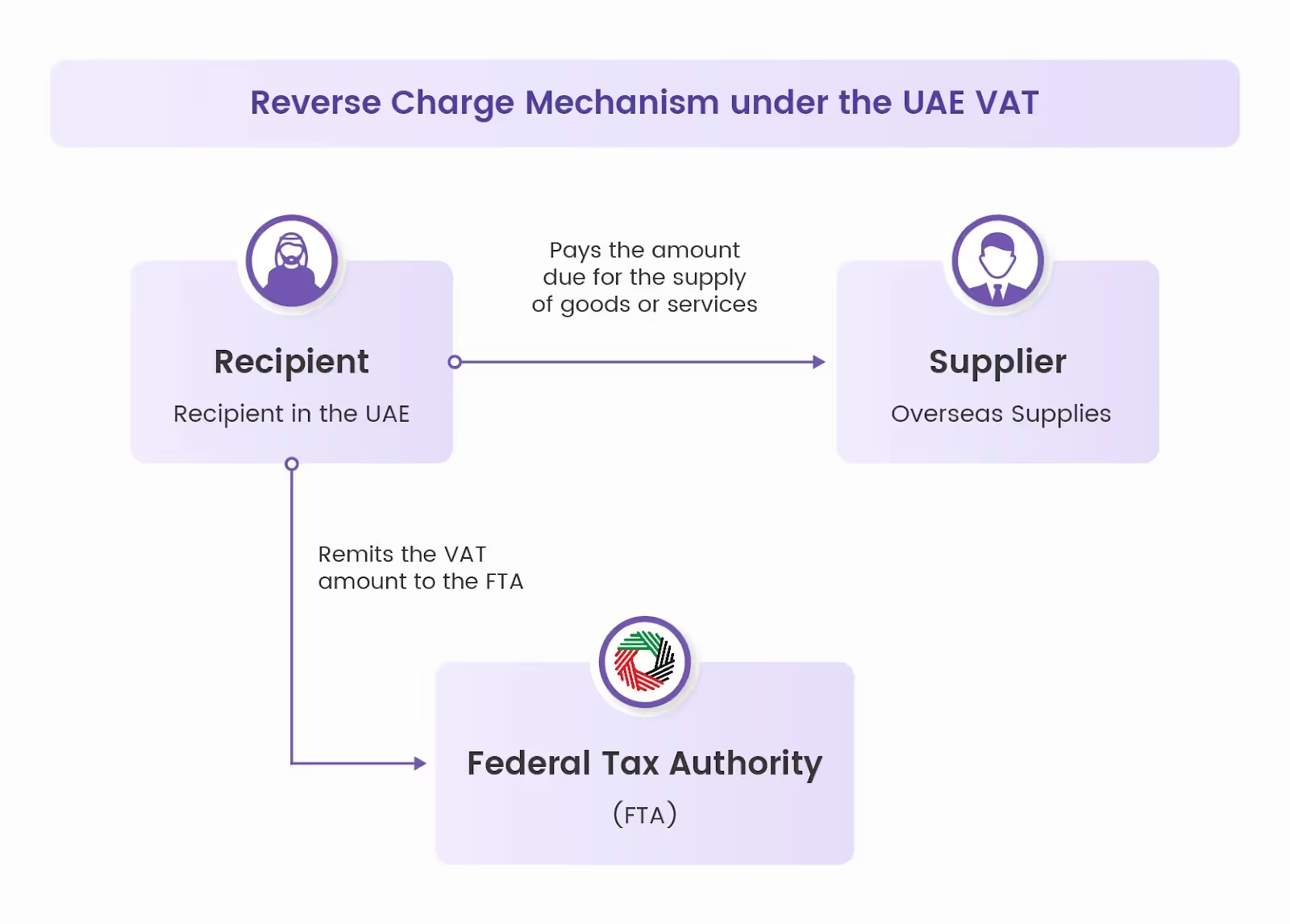

The reverse charge mechanism is a unique system designed to simplify tax processes, especially for businesses that deal with overseas suppliers. In a standard transaction, as a buyer of goods or services, your business would pay VAT to the supplier, who would then be responsible for remitting this tax to the UAE government. However, the RCM shifts this dynamic.

Under the RCM, the responsibility of VAT payment is transferred from the overseas supplier to you, the recipient in the UAE. This is particularly relevant when the supplier has no local presence in the UAE and does not charge VAT. In such a scenario, you would calculate the VAT and pay it directly to the FTA on a reverse charge basis.

As a recipient, you must report both the input VAT on purchases and the output VAT on sales in your quarterly VAT return.

RCM under the UAE VAT example

Let's understand RCM with an example.

Suppose your company imports goods worth AED 10,000 from a supplier in Japan. In a normal transaction (without RCM), your overseas supplier would charge you AED 10,000 for the goods and AED 500 as VAT (5% of AED 10,000). You would pay the supplier a total of AED 10,500, and the supplier would then remit the AED 500 as VAT to the UAE government.

However, under the RCM, your overseas supplier will not charge VAT. Instead, you would pay only AED 10,000 to the supplier for the goods. You would then calculate the VAT of AED 500 (5% of AED 10,000) and pay this amount directly to the UAE government.

You must record this AED 500 as input tax (VAT on your purchases) and output tax (VAT on your sales) in your quarterly VAT return. This means that while you declare the AED 500 as VAT, there is no actual cash flow of VAT.

What is the need for RCM?

The UAE government has introduced various executive regulations to update the VAT Law and ensure ease of doing business in the country. The introduction of RCM is one such rule that addresses several challenges you may face with the FTA due to international transactions:

- Dealing with overseas suppliers: Enforcing VAT rules on foreign entities outside the UAE's jurisdiction can be difficult. The RCM simplifies this situation by shifting the responsibility of VAT payment from the overseas supplier to you. So, you do not need to chase the vendors for filing VAT returns or paying the tax due.

- Managing numerous small vendors: If your company deals with many small vendors, tracking and collecting VAT from each can be a tedious task. This might lead to delayed VAT payments, resulting in potential fines or penalties from the FTA. The RCM allows you to calculate the VAT due for such transactions and remit the payment directly from your company account on time.

- Widening the tax base: The RCM also helps widen the UAE’s tax base by bringing specific cross-border transactions under its scope. Although the supplier is not in the UAE, VAT still accounts for these services. By understanding and applying RCM, your business can stay compliant with the UAE VAT rules and possibly avoid penalties for incorrect reporting or delayed tax payments.

Forward Charge Mechanism (FCM) vs Reverse Charge Mechanism (RCM) in the UAE

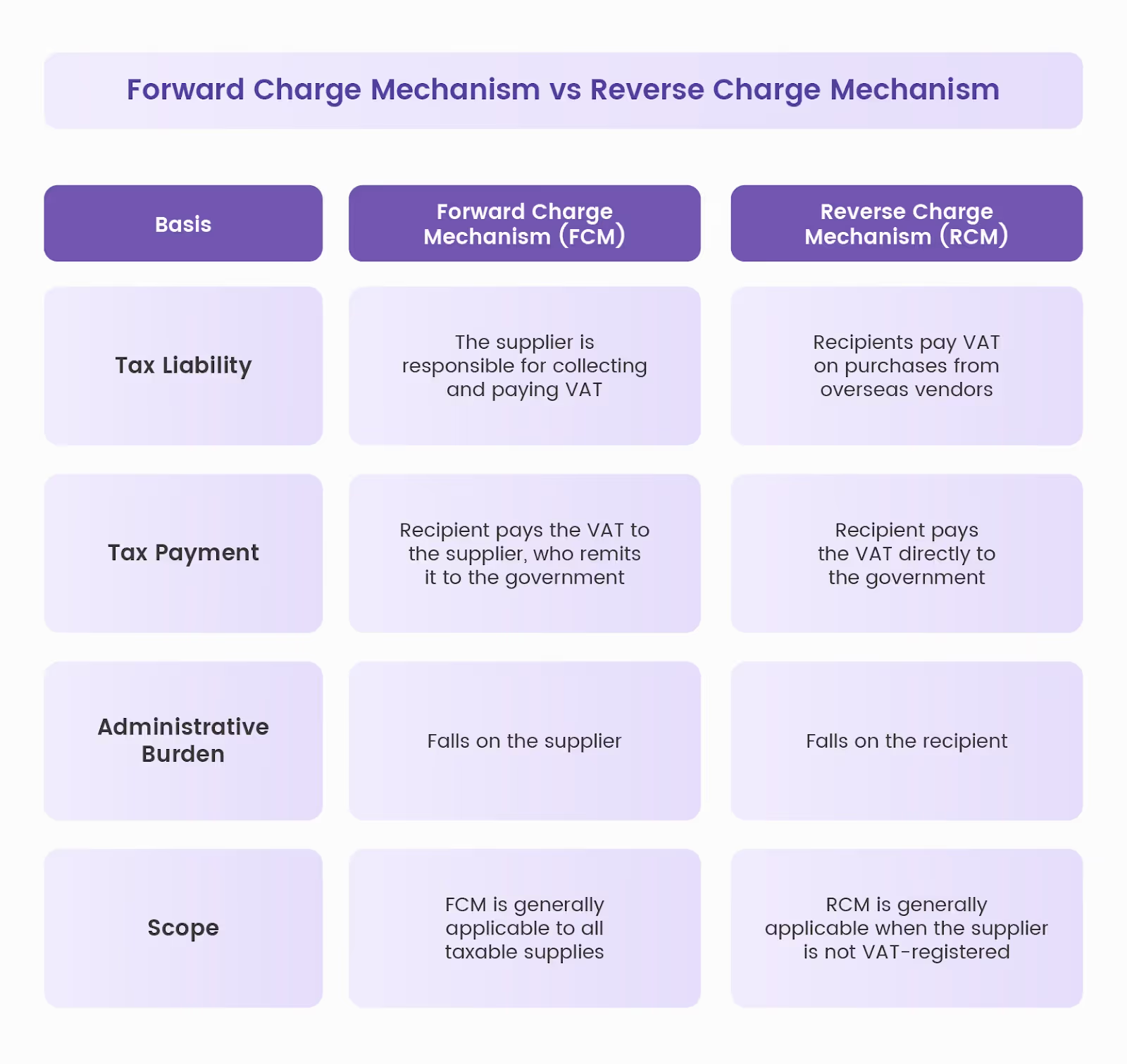

The Forward Charge Mechanism (FCM) and the Reverse Charge Mechanism (RCM) are two important VAT processes in the UAE. Understanding the differences can help you navigate your VAT obligations effectively:

- Tax liability: In the forward charge basis system, the supplier of goods or services is responsible for collecting and paying VAT to the government. However, on a reverse charge basis, as the recipient of goods or services, your business is liable to pay VAT on purchasing materials or services from overseas vendors.

- Tax payment: Under the FCM, you pay the VAT to the supplier, who then remits it to the government. In contrast, under the RCM, you pay the VAT directly to the government. This direct payment can simplify your VAT processes and ensure timely compliance.

- Administrative burden: The FCM places the administrative burden of tax collection and remittance on the supplier. The RCM, on the other hand, places this burden on you, the recipient. While this might seem like an added responsibility, it can give you better control over your VAT processes.

- Scope: The FCM generally applies to all taxable supplies, while the RCM applies only under certain specified conditions, such as when the supplier is not registered under VAT. Understanding when each mechanism applies can help you ensure accurate VAT calculations.

- Compliance: Under the FCM, the supplier is responsible for ensuring compliance with VAT regulations. In contrast, under the RCM, recipients are responsible for compliance, including self-invoicing and VAT payment.

When is reverse charge applicable in the UAE?

Here are some transactions where RCM is applicable under the UAE VAT system:

- If you are importing goods or services, and the supplier is not registered for VAT in the UAE, RCM would likely apply. It is applicable regardless of whether the supplier has a physical presence in the UAE.

- If you purchase goods from a designated zone in the UAE, the RCM might apply. These zones often have specific VAT regulations, so it is important to be familiar with them if your company operates in these zones.

- If you supply or purchase gold and diamonds for resale or further production, the RCM could be applicable.

- If you are a registered recipient in the UAE and are dealing with the supply of hydrocarbons, crude or refined oil, and processed or unprocessed natural gas from a registered supplier, the RCM might apply.

- If your business activities in the UAE include the production and distribution of any type of energy and you supply to a VAT-registered company, the RCM might apply.

Benefits of reverse charge mechanism in the UAE VAT

The RCM offers several benefits for both the government and businesses. Here are some key advantages of the RCM and its impact on the UAE economy:

- Ease for non-resident suppliers: The RCM relieves non-resident suppliers from registering and accounting for VAT in the UAE. This can save them time, resources, and administrative burdens.

- Efficient tax collection: The RCM ensures efficient tax collection, especially in cases where the supplier is not a taxable person, but the supply has been made in the UAE.

- Streamlined VAT processes: For specific transactions like imports, RCM can simplify the administration of your business. Instead of chasing VAT invoices from multiple overseas vendors, you can calculate and pay the VAT directly.

- Prevention of tax evasion: The RCM can help prevent tax evasion by assigning the VAT responsibility to your business. As a recipient, you are directly accountable for reporting and paying VAT on these transactions.

By ensuring VAT is collected on a broader range of transactions, RCM contributes to the UAE's economic stability and growth. This can translate to benefits for your business, such as improved infrastructure, public services, and a stronger overall economy.

Conclusion

By familiarising yourself with RCM under the UAE VAT, you can ensure better FTA compliance and avoid potential penalties. However, managing VAT compliance, especially with RCM transactions, can involve additional record-keeping and calculations.

This is where Alaan, a robust expense management platform, comes in. Alaan can simplify VAT processes for your enterprise with features such as:

- Automated VAT calculations: Eliminate manual calculations for RCM transactions, ensuring accuracy and saving you time.

- Seamless expense tracking: Capture and categorise all your business expenses, including import invoices, for easy VAT reporting.

- Integrated reporting: Generate comprehensive VAT reports that clearly differentiate between standard and RCM transactions, streamlining your tax filing process.

To learn more about how Alaan can help your business, consider scheduling a demo today.

.avif)