Managing finances isn’t just about tracking the cash flowing in and out of a business. Many transactions—like services provided but not yet paid for, or expenses owed but not settled—don’t immediately show up in your bank balance. This gap can obscure a company’s financial health.

Accrual accounting bridges this gap by recording revenues when earned and expenses when incurred, regardless of cash flow. This method ensures financial statements accurately reflect a business’s performance, aligning with global standards like GAAP for deeper insights. Unsurprisingly, nearly 75% of OECD countries now use accrual accounting practices.

In this guide, we’ll break down accrual accounting—its meaning, principles, challenges, and real-world examples—to help you fully understand this critical accounting method.

What Does 'Accrued' Mean in Accounting?

In accounting, 'accrued' refers to revenues or expenses that have been earned or incurred but not yet received or paid. Basically, it represents transactions that have occurred but haven’t been settled in cash yet.

These amounts are recorded in the financial statements to ensure they accurately reflect the company’s financial position, even if the cash hasn’t exchanged hands.

Here’s what it means in simple terms:

- Accrued revenues (Assets): These are earnings that a business has made by providing goods or services but hasn’t yet received payment for.

For example, if a business delivers a project in December but the client pays in January, the revenue is accrued in December.

- Accrued expenses (Liabilities): These are costs that a business has incurred but hasn’t paid yet.

For instance, if a company uses electricity in December but receives and pays the bill in January, the expense is accrued in December.

[cta-10]

Why is this important?

- It helps businesses track financial performance more accurately.

- Provides a clearer view of obligations (like unpaid bills) and expectations (like payments owed by customers).

- Ensures compliance with accounting standards such as GAAP (Generally Accepted Accounting Principles).

Key characteristics of accrued items:

- They reflect economic events, not cash movements

- They may be listed as assets (accrued revenues) or liabilities (accrued expenses) in the balance sheet

- They impact both the income statement and balance sheet through journal entries

Let’s now dive into accrual accounting principles and see how Accrual Accounting ensures precise financial reporting.

The Core Principles of Accrual Accounting

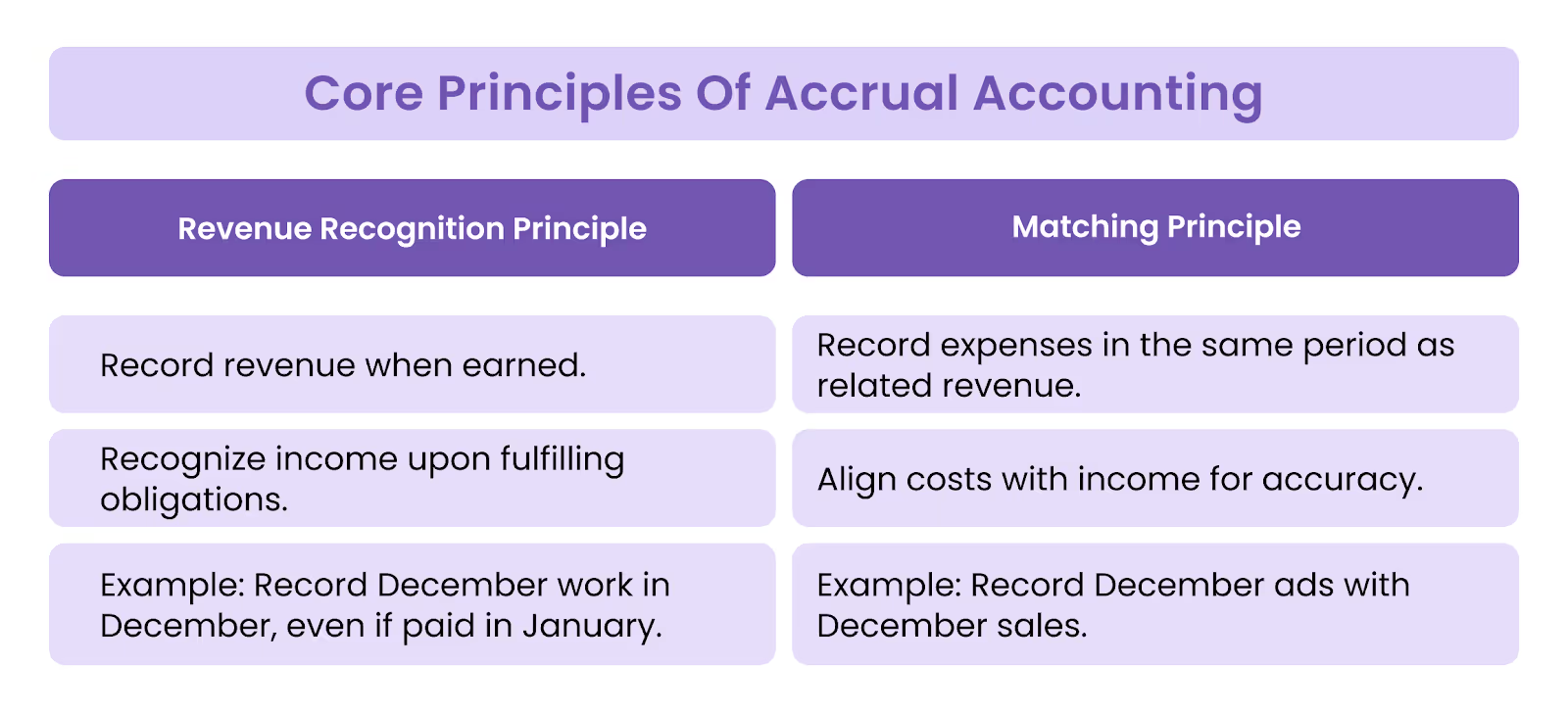

Accrual accounting is based on two fundamental principles: The revenue recognition principle and the matching principle.

These principles provide a framework for recording revenues and expenses when they occur, not when cash is received or paid.

1. Revenue recognition principle

This principle states that revenue should be recorded when it is earned, not when payment is received.

It ensures that income is recognised when the goods or services are provided, even if the cash comes later.

- Revenue is considered “earned” when a business fulfils its obligation to a customer, like delivering a product or completing a service.

- For example, if a company completes a project in December but receives payment in January, the revenue is recorded in December.

2. Matching principle

The matching principle requires expenses to be recorded in the same period as the revenues they help generate.

This provides a clear view of profitability by aligning costs with the income they relate to.

- Expenses are matched with the revenue they directly contribute to, ensuring accurate financial reporting.

- For instance, if a company incurs advertising expenses in December that lead to sales in the same month, the expense is recorded in December.

Why Are These Principles Important?

- They give a realistic picture of a company’s financial health by aligning income and expenses with the time period they occur.

- They improve decision-making by providing accurate data on profits and losses.

- They ensure compliance with accounting standards like GAAP and IFRS, which mandate accrual accounting for most businesses.

With these principles in place, the next step is recording accruals accurately to maintain reliable financial statements.

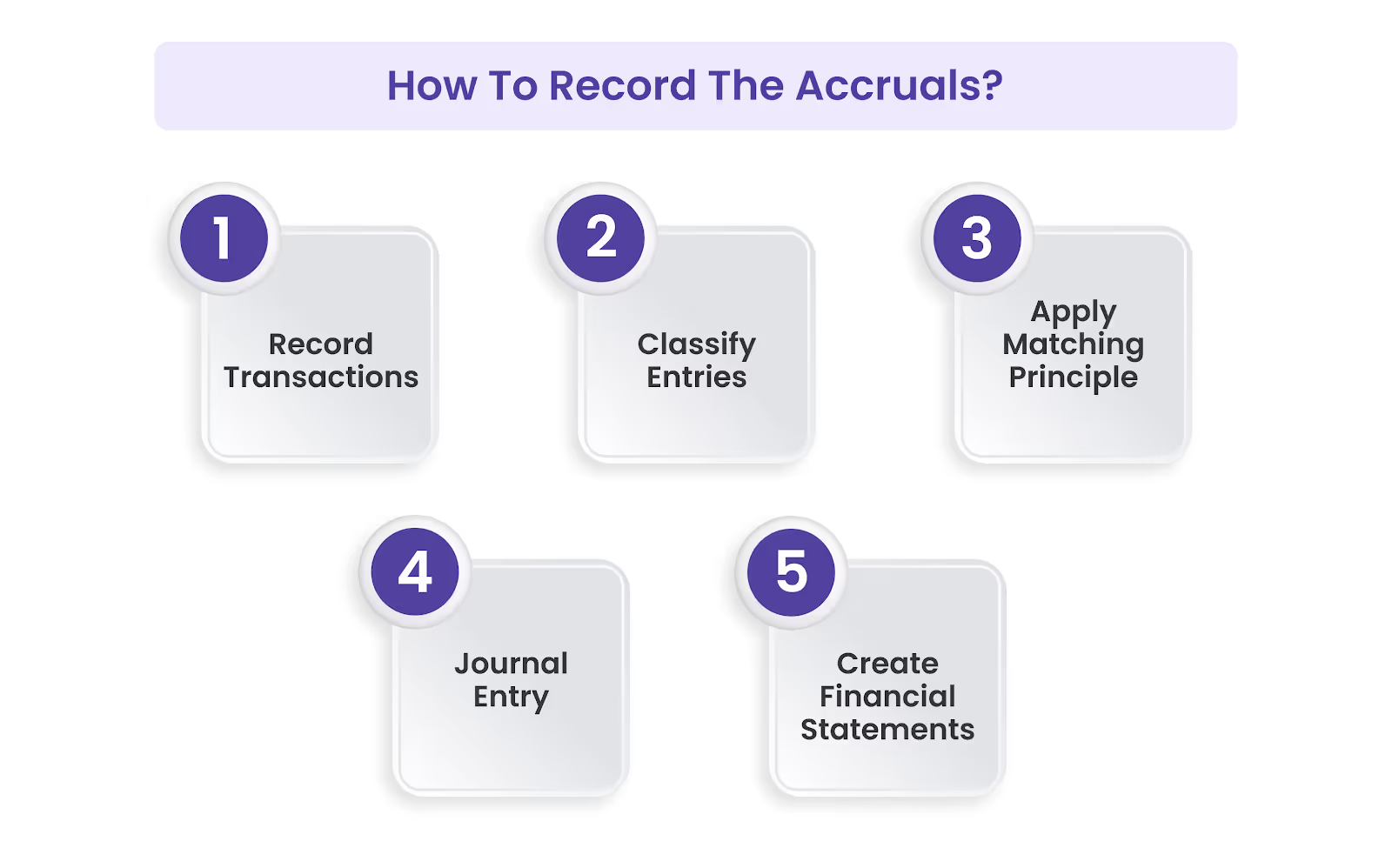

How To Record The Accruals?

Recording accruals involves documenting revenues and expenses in the accounting period they occur, not when cash is received or paid.

Here’s how accruals are recorded in a few simple steps:

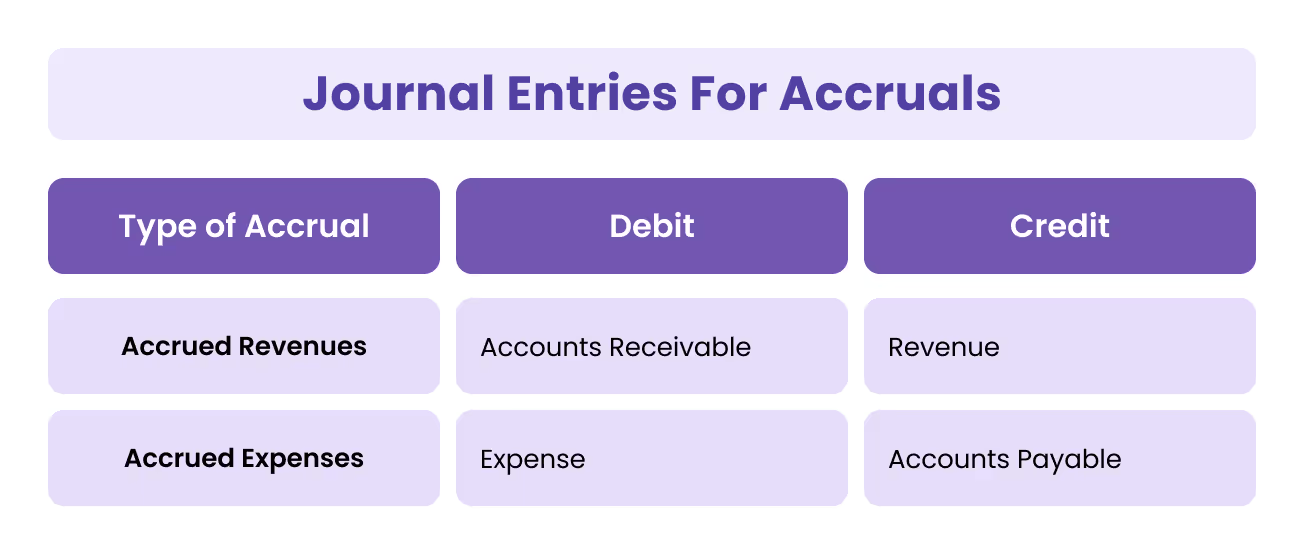

How to record accrued revenues

Accrued revenues refer to income earned but not yet received. For example, if a business provides a service in April but the client pays in June, the revenue is recorded in April. This process involves:

- Debiting the accounts receivable account: This reflects the amount owed by the client.

- Crediting the revenue account: This recognises the income earned during the accounting period.

How to record accrued expenses

Accrued expenses are costs incurred but not yet paid. For example, if a company uses gas in May but pays the bill in June, the expense is recorded in May. This involves:

- Debiting the expense account: This reflects the cost incurred.

- Crediting the accounts payable account: This acknowledges the liability to pay the expense.

Journal entries for accruals

Accruals are recorded using adjusting journal entries at the end of each accounting period to ensure the accuracy of financial statements. Here’s what they look like:

By following these steps, businesses can maintain accurate and reliable financial records.

Challenges of Accrual Accounting and How Alaan Solves Them

While recording accruals ensures accurate financial reporting, it also comes with its own set of complexities. Here’s a look at the common hurdles businesses face and how Alaan makes them effortless to overcome:

- Complexity in tracking revenues and expenses: Businesses must track every transaction, even if cash hasn't changed hands. This process can be time-consuming and prone to errors, especially for organisations managing a high volume of transactions.

Our Solution: With Alaan, businesses can track all expenses and revenues in real-time. Our AI-powered platform automates the categorisation of expenses and matches them with receipts, ensuring every transaction is recorded accurately without manual intervention.

Plus, our seamless integration with your existing accounting software keeps financial records up-to-date effortlessly. - Reconciling accruals with financial statements: Manually reconciling accrued transactions to prepare accurate financial statements can lead to delays and discrepancies, making it challenging to meet deadlines for reporting and compliance.

Our Solution: With one-click reconciliation and real-time updates, Alaan simplifies reconciliation by syncing accrued expenses and revenues directly with your accounting software.

Real-time updates ensure your books reflect accurate data, reducing the time spent on manual adjustments and minimising errors during financial close.

- Managing compliance with tax regulations: Accrual accounting demands strict compliance with VAT and other tax laws, requiring accurate recording of expenses and revenues to avoid penalties.

Our Solution: At Alaan, we simplify VAT compliance with built-in optimisation tools that auto-extract tax details from receipts and flag discrepancies. From recording TRN numbers to validating tax invoices, our platform ensures your business stays tax-ready while maximising VAT savings. - Time-intensive manual processes: The process of recording accruals, verifying expenses, and matching receipts manually can be tedious, leading to inefficiencies and reduced productivity for finance teams.

Our Solution: Alaan eliminates manual tasks by automating accrual entries, receipt verification, and approval workflows. From uploading receipts to syncing with accounting systems, our platform streamlines every step, saving your team hours of work every month.

By addressing these challenges with the right tools and strategies, businesses can fully leverage the advantages of accrual accounting.

To see how these concepts apply in practice, let’s explore some real-world examples of accruals.

Real-World Examples of Accruals

Accrual accounting is not just a theoretical concept—it’s deeply rooted in everyday business operations. Here are some real-world examples that illustrate how accruals work:

- Accrued revenue: Imagine a software company that delivers a project in June but invoices the client in July. Under accrual accounting, the revenue is recorded in June when the service was provided, even though the cash will be received later.

- Accrued expenses: Take a utility company that provides water to businesses throughout August but doesn’t bill its customers until September. The company will record the water costs incurred in August as an accrued expense.

- Wage accruals: A company pays its employees on the 10th of each month for work completed the previous month. For December’s work, the company accrues the wages as an expense in December’s financial statements, even though payment will occur in January.

- Interest accruals: A business takes a loan that accrues interest monthly. Even if the interest is paid quarterly, the business records the accrued interest as an expense at the end of each month to reflect the financial obligation accurately.

- Deferred revenue: A subscription service receives an annual payment from a customer in January. The revenue is recognised monthly throughout the year as the service is delivered, rather than being recorded entirely in January.

[cta-9]

Conclusion

Accrual accounting is a cornerstone of modern financial practices, providing businesses with an accurate and comprehensive view of their financial performance.

Traditional methods, however, can be time-consuming, error-prone, and challenging to scale as businesses grow.

At Alaan, we bridge the gap between complexity and simplicity by automating key accrual processes and delivering real-time insights. From recording transactions to reconciling financial statements, our platform ensures that every aspect of accounting is efficient, accurate, and compliant.

With Alaan, businesses can:

- Save time with automated categorisation and reconciliation of transactions.

- Ensure compliance with VAT and tax regulations using built-in validation tools.

- Gain actionable insights through AI-powered analytics for better financial control.

At Alaan, we focus on helping businesses handle their accrual accounting needs more effectively, simplifying workflows, and providing accurate data for better decision-making. If you're looking to make financial management easier, book a free demo today and see it in action.

.avif)