Corporate cards sound great. No more petty cash headaches or endless reimbursement forms. But with all the options, how do you pick the perfect one for your business? This blog cuts through the clutter! In this article, we will discuss the five best corporate cards for employees in the UAE.

What are corporate cards for employees?

Corporate cards are payment cards issued by a business to its employees for work-related expenses like travel, meals, office supplies, etc. These cards simplify expense management and provide several benefits to both employees and the company. Here are some of the most common ones:

- Corporate cards automate expense tracking and reporting, saving time and resources for employees and finance teams.

- Employees can make business purchases directly without using their personal credit cards or cash and waiting for reimbursement.

- Businesses can benefit from rewards programs offered by many corporate cards, such as cashback or corporate travel points.

- Companies can set spending limits for individual cards, departments, or specific expense categories, ensuring budget compliance.

- Corporate card transactions maintain a detailed audit record for all business expenses, simplifying audits and ensuring transparency in financial reporting.

How to choose the best corporate cards for employees in your organisation?

Several key factors must be considered when selecting corporate cards for your employees. Here is what you should look out for:

1. Expense tracking capabilities

Opt for business card providers that offer expense tracking and reporting features. These capabilities will save your team valuable time by automating expense management and providing clear insights into spending patterns.

For example, At Alaan, our mobile that allows employees to log expenses, categorise them, and attach receipts easily. Our advanced software then generates detailed reports on spending by category, employee, or project, making it easier to track and manage expenses efficiently.

2. Reward program

Look for corporate card providers that offer points, cashback, or travel miles. These rewards can easily offset business expenses or be used for employee incentives, team outings, or travel benefits. The key is finding a card that aligns with your company culture and employee needs without becoming overly complex with points systems or limited redemption options.

At Alaan, we provide up to 2% cashback on all transactions, which can be used anywhere and at any time.

3. International acceptance

If your business operates globally or your employees frequently travel internationally, prioritise cards with broad international acceptance. This ensures smooth transactions and eliminates any hassles when making purchases abroad. At Alaan, our cards are accepted in all countries where a Visa card is accepted.

4. Integration with accounting software

Choose card providers with an in-built expense management platform that seamlessly integrates with your existing accounting software. This integration streamlines financial reporting processes, reduces errors, and enhances efficiency.

Let us say your finance team uses QuickBooks as the accounting platform. Here is how the expense reconciliation process would go:

Without integration:

- Employees manually submit expense reports based on their transactions.

- The accounting team verifies and matches each entry with receipts and enters it into QuickBooks.

With integration:

- Employees submit expenses through the expense management platform, attaching digital receipts.

- The platform automatically categorises each expense and transfers the data to QuickBooks.

- The finance team reviews and approves the pre-populated transactions in QuickBooks.

Using a corporate card program supported by an expense management platform saves hours of manual data entry, reduces errors, and allows the accounting team to focus on more strategic tasks.

5. Security features

Ensure the cards offer robust security features like fraud protection, audit trail, and spending controls. Look for providers that prioritise advanced chip and PIN technology, secure encryption protocols, and effective fraud detection systems. Compliance with PCI DSS standards and proper licensing from financial authorities are essential to ensure data security. This will protect your business from unauthorised transactions and give you peace of mind knowing your finances are secure.

6. Cost considerations

Evaluate the overall costs associated with the cards, including annual fees and interest rates. Look for cards with straightforward pricing structures that avoid hidden fees or charges based solely on card usage or the number of cards issued. The ideal business card should balance low costs and high-value features to fit your organisation's budget and spending needs.

7. Mobile use

Consider card issuers who offer virtual corporate cards and a user-friendly mobile app for easy receipt management. Look for a provider with in-built features like automated receipt matching using OCR technology. This simplifies receipt management and enables your team to handle expenses conveniently from anywhere.

8. Convenience

Verify that the card provider supports mobile payments with Apple Pay and Google Pay. This adds another layer of convenience, allowing employees to make secure payments directly from their mobile devices.

For a detailed guide on the factors to consider while picking the right corporate card provider, check out our corporate card buyer’s checklist.

Top 5 corporate cards for employees in the UAE

When it comes to managing employee expenses in the UAE, businesses have several corporate card options to choose from. Here are the top 5 corporate cards that stand out for their features and benefits:

- Alaan Corporate Card

- HSBC Corporate Card

- Abu Dhabi Islamic Bank Business Gold Covered Card

- RAKBANK Titanium Business Credit Card

- United Arab Bank Mastercard Credit Card

Alaan Corporate Card

Alaan is a leading corporate card provider in the UAE, dedicated to simplifying business spend management. Our prepaid corporate cards allow you to load funds in advance, which can be used for business transactions on the go. Additionally, our in-built expense management platform simplifies expense tracking and helps you get the most out of your company funds.

The standout features of Alaan include:

- Integrated expense management software

- Unlimited supply of virtual and physical cards

- Advanced chip and pin technology (secure encryption)

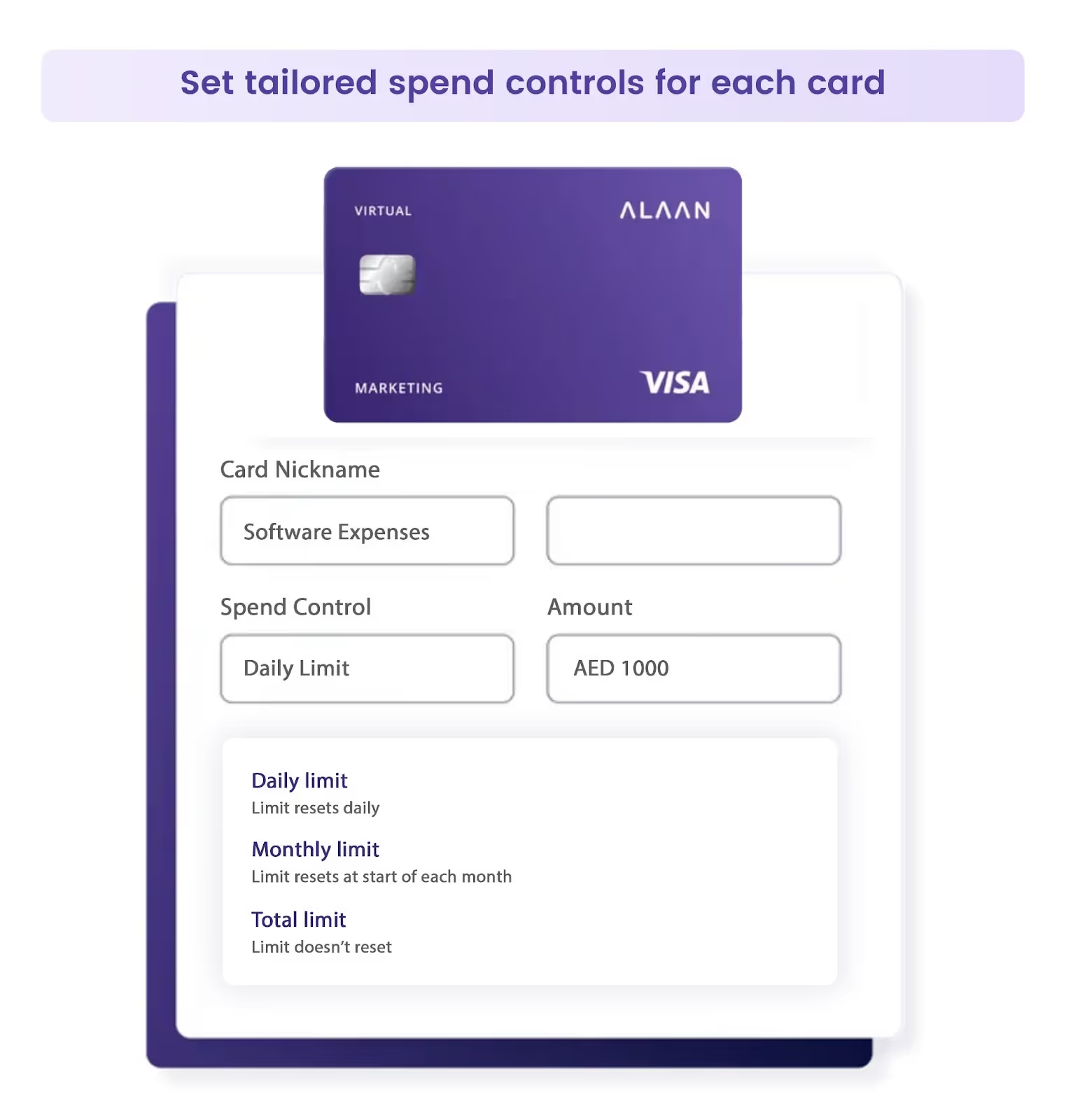

- Customisable card limits across the organisation

Why should you consider Alaan?

- Unlimited 2% cashback on all transactions — domestic and international

- Liability waiver insurance coverage of up to $25,000 per cardholder and $1,650,000 per company annually

- Discounts across platforms like Google Workspace, DocuSign, MailChimp, GreytHR, etc

- Supports over 200 currencies worldwide

- Integrates with mobile wallets like Apple Pay and Google Pay

Ideal for: It caters to businesses of all sizes and needs.

HSBC Corporate Card

The HSBC Corporate Card is a simple way to control business expenditures and manage working capital more effectively. You can use the card for everyday travel and entertainment and pay for goods and services. A few things that set the HSBC card apart from the rest:

- Fifty-five days interest-free period to improve your cash flow

- No corporate liability for misuse by cardholders

- Accepted at over 52.9 million locations worldwide

Ideal for: Larger companies with frequent travel and entertainment

Abu Dhabi Islamic Bank Business Gold Covered Card

Abu Dhabi Islamic Bank (ADIB) is a financial services provider that offers Shariah-based banking, financing, and investment services. The ADIB Business Gold Covered Card is designed to meet business needs with:

- Advanced chip and pin technology

- Supply of unlimited supplementary cards

- 55 days grace period for repayment of the outstanding balance

Ideal for: Businesses seeking Sharia-compliant solutions

RAKBANK Titanium Business Credit Card

The RAKBANK Titanium Business Credit Card is a corporate card solution offered by RAKBANK, one of the prominent banks in the UAE. The card is designed to meet the needs of businesses operating in the region. Here is what you might like about this card:

- 1% Cashback on all domestic and international- retail, internet, and cash transactions

- No annual fee

- Optional insurance for default payments due to unforeseen circumstances

Ideal for: Cost-conscious businesses with high spending

Commercial Bank of Dubai VISA Platinum Credit Card

The Commercial Bank of Dubai (CBD) offers a comprehensive platinum business credit card designed to cater to the financial needs of businesses operating in the UAE. This card provides a range of benefits and features that can help streamline business expenses and enhance financial management. A few things that make CBD stand out from the rest:

- Cards are free for life

- Access to credit for up to 52 days interest-free

- Free supplementary cards

Ideal for: Businesses prioritising cash flow, especially those with low foreign transactions and manageable monthly expenses.

Is Alaan corporate card for you?

If you are looking for a corporate card to simplify your business expenses and provide a seamless experience for your employees, Alaan Corporate Cards might be the perfect choice. Designed to streamline expense management and boost transparency, here is how our cards can benefit your business:

Real-time expense tracking

Our corporate cards and expense management solution offer real-time expense tracking, ensuring complete visibility into your business expenses. This feature minimises errors, enhances financial oversight, and supports proactive decision-making by identifying areas for cost optimisation.

Rewards programme

Like our cards, our rewards are simple: Get up to 2% cashback on all your spends. Cashback is transferred to your wallet directly and can be used anywhere.

Customisable spending limits

With our corporate cards, you can set custom spending limits for each employee. This helps prevent overspending and manage your business expenses. Limits can be based on roles, departments, or projects to keep expenses aligned with your business goals.

Fraud prevention features

We also offer robust fraud prevention features that help protect your business from unauthorised and unusual transactions. These features include real-time transaction monitoring, automated receipt matching, and secure payment processing.

With our fraud prevention features, you can rest assured that your business expenses are accurately tracked and reported, reducing the risk of errors and disputes.

Curious to learn more about Alaan corporate cards? Get in touch with us today!

.avif)