Legal spending is one of the most unpredictable cost categories for UAE businesses. A routine contract review may expand into multiple negotiation rounds, and a compliance query can require extensive external counsel time. Demand for legal services has been rising as companies navigate new corporate tax rules, VAT updates and complex commercial agreements. The DIFC Courts alone recorded AED 15 billion in claim value across 455 cases in the first six months of 2023, reflecting the scale and financial significance of legal disputes involving businesses in the region.

In this blog, we explain what legal expenses include, how they should be classified and accounted for, the UAE tax and VAT implications involved and the controls finance leaders can implement to manage legal spending effectively.

Key Takeaways

- Legal expenses cover advisory, documentation, disputes and compliance work, and must be classified accurately for reporting, tax and budget control.

- Most legal fees are operating expenses, but some must be capitalised when linked to asset acquisition, financing or long-term business value.

- Deductibility under UAE corporate tax depends on business relevance and documentation. Fees linked to violations or personal matters are not deductible.

- Poor visibility, duplicate billing, vague invoices and retainer overspend are common risks that make legal expenses challenging to manage.

What Legal Expenses Mean for a Business

Legal expenses are the professional fees and related charges a company pays when obtaining legal advice, representation or documentation. These costs reflect the regulatory and contractual environment in which a business operates, especially in the UAE where commercial agreements, employment matters and regulatory updates often require specialist legal input.

How legal expenses differ from other professional fees

Although legal fees fall within professional services, they require distinct tracking because they carry financial reporting and compliance implications. Legal invoices usually include matter descriptions, hourly rates, fee breakdowns and VAT classifications. Misclassification can lead to accounting inaccuracies and audit issues.

Examples of legal expenses in UAE organisations

- advisory services for commercial, tax or employment matters

- reviewing or drafting legal documents

- support during disputes or regulatory reviews

- legal due diligence in transactions

- intellectual property-related work

- legal retainers for ongoing advisory

Costs that should not be categorised as legal expenses

- government licence and certification fees

- stand-alone notary or attestation charges

- consulting fees that do not involve legal interpretation

- compliance reviews carried out by non-legal professionals

A clear expense structure prevents misstatements across legal, regulatory and administrative cost categories.

Also read: Types of Expenses in Business Expense Management

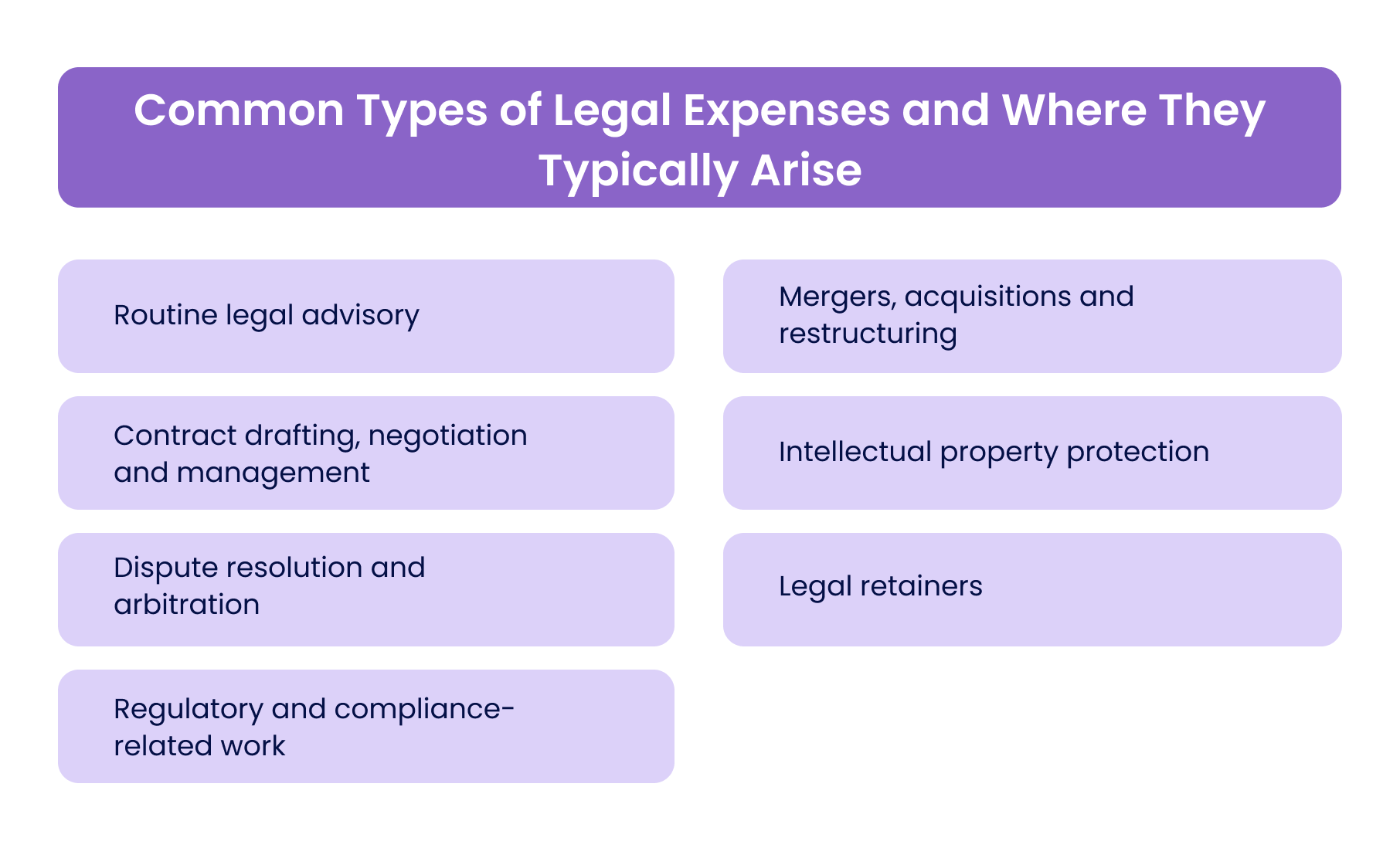

Common Types of Legal Expenses and Where They Typically Arise

Legal fees do not follow a single pattern. They arise from day-to-day operations, long-term projects, regulatory requirements and one-off events. For UAE companies, the most common categories include:

1. Routine legal advisory

This includes commercial advisory, contract reviews, employment queries, shareholder updates and interpretation of new regulations. These activities often represent the largest share of annual legal spending.

2. Contract drafting, negotiation and management

Businesses rely heavily on external counsel when negotiating vendor agreements, drafting supply contracts, updating terms of service or reviewing leases. Contractual precision is especially important in sectors such as real estate, construction, e-commerce and professional services.

3. Dispute resolution and arbitration

Mediation, arbitration and litigation bring significant legal costs. Even when disputes are settled early, advisory and documentation fees can be substantial. For UAE businesses, arbitration centres such as DIAC play an important role in commercial conflict resolution.

4. Regulatory and compliance-related work

This includes legal interpretation of corporate tax updates, VAT changes, labour regulations and sector-specific compliance. Finance teams rely on legal counsel to avoid regulatory breaches and ensure documentation meets audit standards.

5. Mergers, acquisitions and restructuring

Legal due diligence, SPA review, regulatory filings and deal structuring attract complex fee structures. These costs often require careful capitalisation assessment.

6. Intellectual property protection

Trademark registrations, renewals, infringement claims and licensing agreements all fall under legal expenses.

7. Legal retainers

Many UAE organisations maintain monthly or quarterly retainers with law firms for ongoing support. While convenient, retainers must be monitored closely to avoid overspend and scope drift.

A structured view of these categories helps finance teams allocate costs accurately and maintain visibility across multiple legal matters.

Also read: Track and Manage Business Expenses

How Legal Expenses Are Treated in Accounting

.png)

Legal expenses require careful classification because they directly influence financial reporting, tax treatment and audit readiness. Finance teams must understand when these costs are recognised as operating expenses, when they need to be capitalised and how they affect disclosures.

1. When legal expenses are operating expenses

Most legal fees are treated as operating expenses, particularly when they relate to day-to-day business activity. Examples include:

- contract reviews

- advisory services

- employment matters

- compliance checks

- general dispute handling

Under accrual accounting, the expense is recognised in the period the service is received, even if the invoice is submitted later. This ensures that the financial statements fairly represent costs associated with the reporting period.

2. When legal expenses must be capitalised

Certain legal costs form part of the value of an asset or financial arrangement. These must be capitalised rather than expensed immediately. Common examples include:

- legal fees for property acquisitions

- documentation linked to long-term financing arrangements

- costs associated with issuing shares or raising capital

- legal work directly connected to obtaining a licence or asset that provides long-term benefit

Capitalising these expenses improves accuracy in the balance sheet and ensures the cost is spread over the useful life of the underlying asset or transaction.

3. Accrual considerations for legal fees

Legal invoices often arrive several weeks or months after work is completed. Without a proper accrual process, expenses can be overstated or understated. Finance teams should:

- request detailed engagement letters

- track ongoing legal matters with expected timelines

- maintain an internal accrual schedule

- confirm with counsel at month-end whether additional fees are pending

This avoids late surprises and helps maintain accurate forecasts.

4. Provisions, contingent liabilities and IFRS requirements

Legal disputes can materially affect financial statements. IFRS requires organisations to assess the likelihood of losses and disclose them appropriately. This includes:

- recognising provisions when a probable obligation exists

- disclosing contingent liabilities for uncertain outcomes

- documenting assumptions and legal opinions used in the assessment

Finance and legal teams must collaborate to ensure provisions reflect accurate risk exposure and comply with IFRS guidance.

5. Audit readiness and supporting documentation

Auditors often request copies of:

- legal invoices

- engagement letters

- retainer agreements

- matter-level correspondence

- evidence of management's assessment of provisions

This documentation helps verify completeness, existence and accuracy of legal expenses.

Also read: Guide to Preparing Financial Statements Efficiently

Tax and VAT Implications of Legal Expenses

Legal expenses have direct consequences for UAE corporate tax and VAT compliance. Deductibility depends on the nature of the legal work and its connection to business activity.

1. Legal expenses that qualify as deductible

Legal fees are generally deductible for corporate tax purposes when they relate to:

- normal business operations

- revenue generation

- employment and HR matters

- commercial contracts

- compliance with statutory obligations

Routine legal advisory typically qualifies, as long as it is directly linked to business activity.

2. Legal expenses that are not deductible

Certain expenses are disallowed for tax purposes. These include:

- legal costs arising from penalties or violations

- matters associated with unlawful conduct

- legal fees related to non-business personal matters

- costs that fail to meet documentation or VAT requirements

UAE corporate tax guidelines require finance teams to segregate these items clearly to avoid disallowed deductions during reviews or audits.

3. VAT treatment of legal services in the UAE

Legal services are generally subject to VAT at the standard rate. To claim input VAT, companies must ensure that legal invoices include:

- supplier TRN

- correct VAT amount

- accurate legal name of the recipient

- service description that reflects the nature of the legal work

- date and invoice reference number

Missing details can lead to rejected VAT claims or compliance penalties.

4. Documentation required for tax substantiation

Finance teams must maintain:

- engagement letters

- invoices with VAT compliance

- proof of payment

- correspondence showing the business purpose of legal work

UAE authorities expect detailed support, especially where deductions are significant or disputes relate to operational risk.

Related: Deductible and Non Deductible Expenses Under UAE Corporate Tax

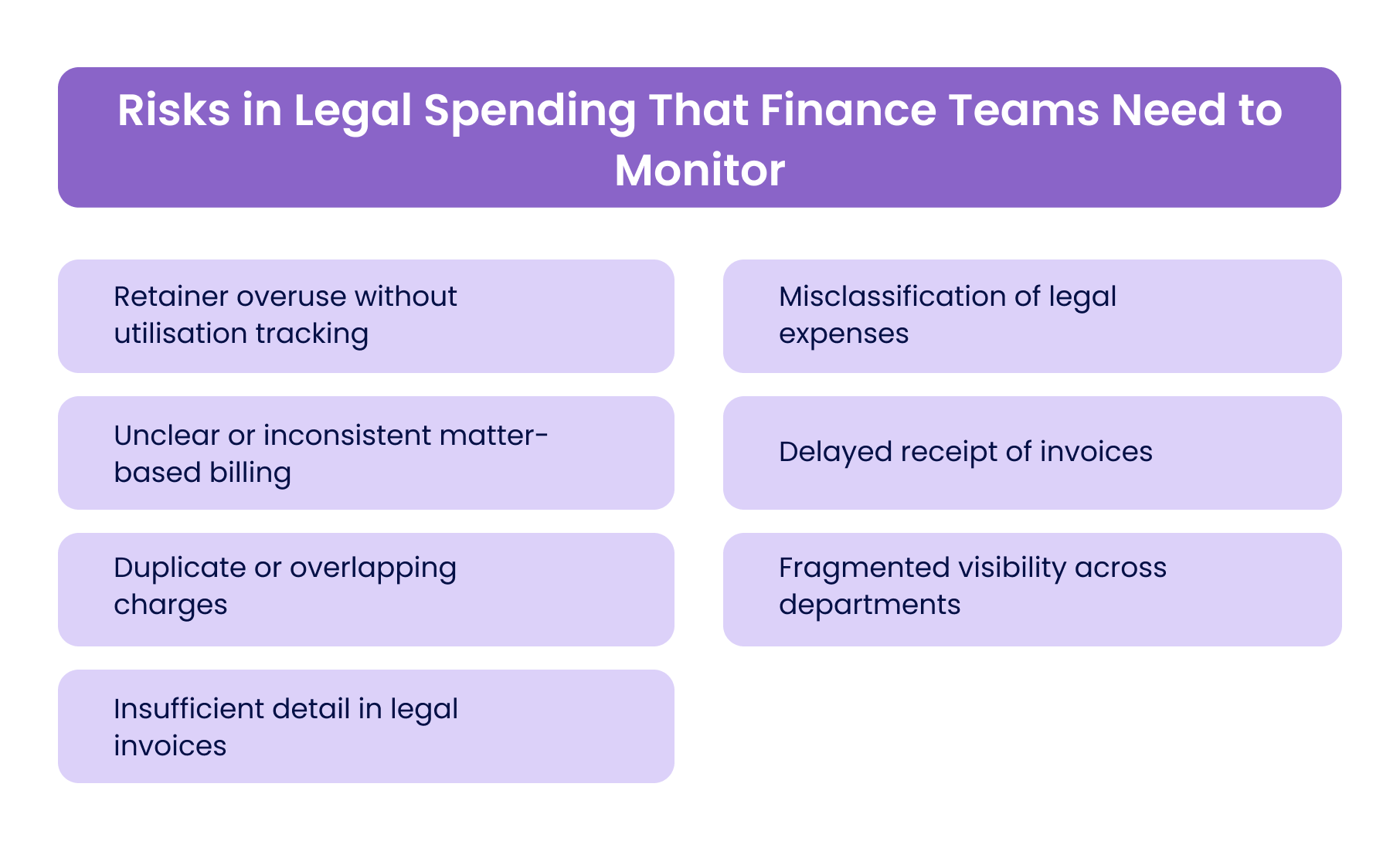

Risks in Legal Spending That Finance Teams Need to Monitor

Legal spending is one of the more unpredictable cost categories for finance teams. Without structured oversight, costs can escalate quickly, documentation may be incomplete, and forecasting becomes difficult. These are the specific risks finance leaders in UAE organisations should monitor.

1. Retainer overuse without utilisation tracking

Retainers provide convenience, but they can mask inefficiencies. When hours are consumed without visibility, organisations may pay for services that were not necessary or that fall outside the agreed scope.

2. Unclear or inconsistent matter-based billing

Without matter codes or departmental allocation, it becomes difficult to verify which business unit initiated the work or whether the charges align with the scope. Lack of clarity also makes it harder to consolidate spending across the organisation.

3. Duplicate or overlapping charges

Legal work typically involves multiple rounds of revisions or parallel input from different team members. If billing is not monitored closely, companies may unknowingly pay twice for similar work.

4. Insufficient detail in legal invoices

Legal invoices often vary in structure. When descriptions are vague or lack clear breakdowns, finance teams cannot assess whether the fees align with the original engagement or if the charges are reasonable for the work performed.

5. Misclassification of legal expenses

Coding legal expenses to incorrect categories distorts reporting, affects departmental budgets and creates inconsistencies in financial statements. Miscoding also complicates audits and tax reviews.

6. Delayed receipt of invoices

Many legal matters span long periods. When invoices arrive several weeks or months after work begins, accruals become inaccurate and forecasts lose reliability. Month-end processes then require adjustments that increase workload.

7. Fragmented visibility across departments

Legal spending can originate from HR, procurement, operations, finance, marketing or executive teams. When oversight is decentralised, organisations risk losing visibility into their total legal exposure and may miss opportunities for improved fee negotiations.

Related: Understanding Spend Visibility: Business Benefits

What a Strong Legal Expenses Policy Should Include

A well-defined legal expenses policy helps organisations maintain control, avoid overspend and ensure that legal work is authorised, documented and compliant. It also creates consistent expectations for employees, external counsel and finance teams.

1. Scope and eligibility

The policy should define which types of legal work require external counsel. It should also outline the matters that must be routed through the legal department and those that may be handled internally.

2. Pre-approval requirements

Clear approval thresholds prevent unplanned legal spending. For example:

- routine advisory below a certain value may be approved by the department head

- litigation or arbitration matters must be approved by the CFO or legal head

- any engagement over a set budget requires executive approval

This prevents departments from initiating costly legal work without visibility.

3. Budget allocation and spend limits

Finance teams should establish budgets for legal matters based on expected scope. This helps avoid runaway costs during disputes, negotiations or regulatory reviews.

4. Retainer management guidelines

The policy should define how retainers are selected, structured and reviewed. It should also specify:

- maximum monthly limits

- scope of work

- reporting expectations

- performance evaluation criteria

5. Documentation and invoice standards

Every legal invoice should include:

- detailed matter description

- hourly rates or fixed fee structure

- TRN and VAT-compliant formatting

- supporting documents such as time sheets or breakdowns

This ensures readiness during audits and VAT reviews.

6. Payment workflow and review steps

Finance teams should review legal invoices against engagement letters, matter status reports, and internal approvals. A centralised workflow reduces misclassification and improves compliance.

[cta-3]

Also read: Effective Business Spending Policies

Understanding Legal Expenses Insurance and When It Is Useful

Legal expenses insurance provides coverage for specific types of legal costs that may arise during business operations. Although not mandatory, it is increasingly considered by organisations that face ongoing regulatory obligations, contractual exposure, or a high volume of employee-related matters. Finance leaders evaluate this insurance not as a replacement for counsel, but as a way to stabilise unpredictable legal costs.

1. What legal expenses insurance typically covers

Policies usually cover legal costs associated with:

- employment disputes

- contractual claims brought by or against the business

- regulatory investigations

- arbitration and mediation fees

- debt recovery actions

- certain professional negligence claims

The extent of cover depends on the selected policy and the insurer's risk appetite. Some plans provide broader protection, while others limit coverage to specific types of disputes.

2. What legal expenses insurance does not cover

Exclusions are important to understand because they shape budgeting and risk management. Common exclusions include:

- claims arising from criminal or unlawful activity

- disputes the company was already aware of before purchasing the policy

- matters tied to deliberate misconduct

- fines or penalties

- disputes outside the policy jurisdiction

Companies often overlook these exclusions, which can lead to unexpected out-of-pocket costs.

3. When organisations in the UAE consider this insurance

Legal expenses insurance is often evaluated by:

- real estate and construction firms that manage large contract portfolios

- healthcare providers facing regulatory inspections and patient-related claims

- logistics and transportation companies dealing with cross-border commercial disputes

- professional service firms exposed to client disputes

- businesses with frequent HR or employment-related cases

In these sectors, the volume and complexity of legal matters can be significant, making cost predictability valuable.

4. How insurance influences budgeting and cash flow

Legal disputes are one of the most difficult expense categories to forecast. Insurance helps finance teams:

- reduce large, unexpected cash outflows

- maintain stable budgets for legal matters

- improve visibility when preparing financial forecasts

- evaluate risk transfer options rather than absorbing all costs directly

How Modern Finance Teams Track and Control Legal Spending More Effectively

Legal expenses become more manageable when finance teams have the right controls, visibility and processes in place. Traditional invoice-based tracking is not enough to maintain accuracy, especially when matters span several months and involve multiple stakeholders. A structured approach helps organisations reduce waste and improve governance.

1. Use matter-based cost allocation

Every legal activity should be assigned a unique matter code. This enables:

- proper cost allocation

- departmental accountability

- more accurate comparisons between projected and actual spend

- clear reporting during audits

Matter coding is particularly helpful when cases involve multiple teams or a mix of external and internal inputs.

2. Introduce spend caps and engagement limits

Before work begins, finance and legal teams should define maximum budgets for each matter. Spend caps prevent unexpected overruns and give management early visibility when a dispute or negotiation becomes more complex than anticipated.

3. Compare hourly billing with fixed fee arrangements

Hourly billing can become unpredictable. Many firms in the UAE now offer fixed fee structures for common services such as contract drafting, employment advisory and compliance reviews. These arrangements help stabilise legal budgets while maintaining quality.

4. Establish real-time visibility into legal spending

Consolidated reporting across all departments is essential. When spending is tracked only at month-end, teams lose the opportunity to correct issues early. Real-time insights allow finance leaders to:

- identify duplicate charges

- prevent miscoded expenses

- review scope alignment against the engagement letter

- understand which matters are trending above budget

5. Reduce manual reconciliation and human error

Legal invoices are detail-heavy. Without automation, teams spend considerable time verifying amounts, matching invoices to matters, and ensuring VAT compliance. Automation reduces manual checks, flags inconsistencies and creates an audit-ready trail.

Also read: Modern Expense Management Systems

How Alaan Helps Businesses Manage Legal Expenses Better

Legal spending becomes easier to manage when finance teams have strong controls, accurate categorisation and real-time visibility. At Alaan, we help organisations bring structure and consistency to legal expenses by combining corporate cards, automated expense workflows and accounting integrations.

1. Vendor level controls for legal service providers

Teams can assign dedicated cards to specific law firms or legal departments with predefined limits. This ensures that all legal payments follow approved budgets and prevents unauthorised or unexpected charges.

2. Real-time tracking of legal transactions

Every payment made using an Alaan corporate card appears instantly on the platform. Finance leaders can monitor spending against matter-level budgets and quickly identify unusual transactions or charges that exceed expected scope.

3. Automated receipt capture and invoice management

Legal invoices often include detailed fee breakdowns. Alaan allows employees to upload invoices directly through the app or Chrome extension. Alaan Intelligence extracts and matches details to the corresponding transaction, reducing manual review work.

4. VAT validation for legal invoices

Law firm invoices must meet VAT requirements to be eligible for input VAT claims. Alaan automatically checks for missing TRNs, invoice inconsistencies or incorrect VAT amounts, helping finance teams avoid compliance issues and rejected claims.

[cta-6]

5. Accurate categorisation with AI-driven learning

Alaan Intelligence learns from historical data and categorises legal transactions consistently across departments. This minimises miscoding, improves reporting accuracy and streamlines reconciliation.

6. Smooth month-end reconciliation with accounting integrations

Legal invoices can arrive late, but finance teams should not wait for manual reviews. With integration to Xero, QuickBooks, NetSuite and Microsoft Dynamics, expenses sync automatically. This ensures real-time updates to the books and reduces the burden on accountants during month-end close.

Conclusion

Legal expenses are a regular part of doing business, especially in a regulatory environment that evolves rapidly. Their unpredictability makes them one of the most important cost categories to track with precision. Finance teams that understand how legal fees are classified, how they affect tax outcomes and which risks require active monitoring are better equipped to maintain accurate financial reporting and avoid overspending.

By combining well-defined policies with real-time visibility and automated controls, organisations can manage legal costs more responsibly and prevent surprises at month-end.

At Alaan, we help organisations manage legal expenses with real-time transaction tracking, automated invoice capture, spend controls and accounting integrations that keep books accurate at month-end. If your finance team wants deeper visibility and stronger oversight of legal costs, book a free demo to see how Alaan can support you.

Frequently Asked Questions (FAQs)

1. Are all legal expenses deductible under UAE corporate tax?

No. Legal fees are deductible only when they relate to business activity and are supported by compliant documentation. Expenses linked to penalties, violations, unlawful conduct or non-business personal matters are not deductible.

2. How can organisations prevent duplicate or inflated legal bills?

Finance teams should compare invoices against engagement letters, track matter-level spending and require detailed fee breakdowns. Real-time visibility helps detect repeated charges, out-of-scope work and inconsistencies between billed hours and actual progress.

3. What should a strong legal expenses policy include?

A robust policy defines eligibility, approval thresholds, documentation requirements, retainer guidelines, spending limits, invoice standards and payment workflows. Clear rules prevent uncontrolled spending and ensure the organisation maintains audit-ready documentation.

4. When should a business consider legal expenses insurance?

Insurance is useful for organisations with frequent disputes, complex regulatory environments or high exposure to contractual claims. Sectors like real estate, construction, healthcare and logistics often evaluate legal expenses insurance to stabilise unpredictable cost spikes.

5. How do delayed legal invoices affect financial reporting?

Late invoices distort accruals, create forecasting errors and complicate month-end close. Maintaining expected-fee schedules and confirming pending work with counsel helps finance teams adjust provisions accurately.

.avif)