Across the Middle East, businesses are sitting on nearly $54.7 billion in trapped cash, funds locked up in slow collections, inefficient payments, and poor expense visibility. For CFOs and finance leaders in the UAE, that’s more than a statistic; it’s a mirror reflecting daily operational friction and missed opportunities.

When burn rate isn’t measured with precision, cash quietly leaks through delays, manual workflows, and reactive cost control. But when you track it in real time and embed visibility into every financial decision, burn rate becomes more than a metric, it becomes a growth compass.

In this blog, you’ll learn what a cash burn rate is, how to calculate it accurately, and how to use it as a strategic anchor to drive sustainable growth and stronger liquidity.

Key Takeaways

- Understanding Cash Burn Rate: Measures how quickly a company depletes its cash, gross burn tracks outflows; net burn shows true liquidity pressure.

- Healthy Burn Benchmarks: Strong businesses maintain a burn multiple between 1–1.5 for capital efficiency and sustainable growth.

- How to Calculate Burn and Runway: Net burn = (starting cash – ending cash) ÷ months; runway = cash ÷ net burn.

- Managing and Reducing Burn: Control spend through limits, vendor reviews, automation, and scenario planning to extend runway without slowing growth.

- Embedding Burn Monitoring: Use dashboards, ERP integration, and AI-powered compliance to keep burn visible and build investor confidence.

Why Burn Rate Could Be the Most Honest Metric in Your Business

Burn rate is not just a startup number. It reflects how well a business controls its spending and how effectively it converts cash into progress.

Gross burn shows the company’s total monthly commitments such as salaries, rent, and vendor payments. Net burn shows the actual reduction in cash after accounting for inflows.

Together, they reveal two things that matter most: how long a business can sustain operations and how efficiently it uses its capital.

Boards and investors see burn rate as an indicator of control. A consistent burn that matches growth targets signals sound financial discipline. A rising burn with limited returns often points to weak controls or poor visibility.

Companies that track burn regularly do more than monitor cash flow. They use it to guide decisions, manage funding cycles, and maintain confidence across leadership and investors alike.

What a Healthy Burn Rate Looks Like Across Stages And Sectors

There is no single number that defines a healthy burn rate. It depends on the company’s size, growth stage, and access to capital. What matters most is how well spending supports growth without shortening the company’s runway.

Early-stage companies usually experience higher burn as they invest in product and market validation. As the business matures, burn should stabilise and align more closely with revenue growth.

A useful measure for assessing efficiency is the burn multiple, which compares net burn to net new revenue. Strong businesses maintain this between 1 and 1.5, meaning that every dirham spent produces at least one dirham in additional revenue.

Below is a general view of how burn patterns vary by phase and sector, based on market observations across the UAE and KSA:

Benchmarks by Growth Phase

Benchmarks vary by sector (e.g. SaaS, e-commerce, logistics, real estate) and by regional cost structures such as wages, rent, and VAT.

When net burn multiples rise above 2–3 or the runway falls under six months, both investors and internal stakeholders treat it as a red flag. Even profitable companies track burn to protect margins and credibility.

Once you know the benchmarks, the next step is learning how to calculate burn in practical terms.

Also Read: Building a Robust Cash Management Control System for UAE Businesses

How to Measure and Interpret Burn Rate Accurately

Burn rate is one of the simplest metrics in finance, yet it often gets misread. The value lies not only in the number but in understanding what it represents — the pace of cash movement and the efficiency behind it.

There are two ways to calculate burn rate, each offering a different view of financial health.

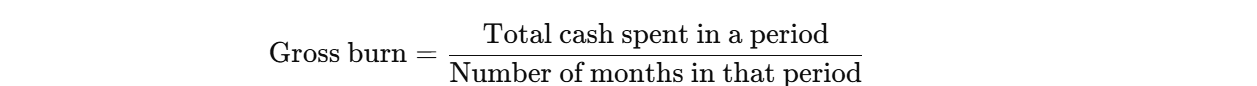

Gross burn

This shows the total monthly cash outflow, regardless of revenue. It helps identify cost concentration and spending patterns.

Formula:

Example: If a company spends AED 1.2 million in six months, gross burn is AED 200,000 per month.

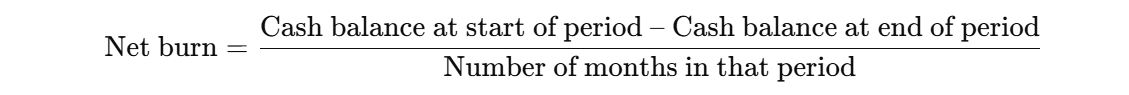

Net burn

This reflects how much cash the company actually loses each month after considering inflows. It gives a truer picture of liquidity pressure.

Formula:

Example: If a company starts with AED 5 million, ends six months with AED 3.8 million, the net burn is AED 200,000 per month.

Cash runway

Burn rate directly informs runway, the number of months a company can continue operating before cash runs out.

Formula:

Example: With AED 2 million in the bank and a net burn of AED 200,000/month, the runway is 10 months.

A clear view of gross burn, net burn, and runway helps finance teams spot early warning signs, plan funding cycles, and maintain investor confidence.

But tracking the numbers is only part of the job. The next step is learning how to manage and influence them directly.

[cta-1]

Controlling Cash Burn Before It Controls You

Tracking burn rate is only useful when it shapes decisions. The goal is to act on the levers that directly influence monthly cash outflows while keeping growth priorities intact.

Below are five practical ways to manage and control burn more effectively:

1. Tighten spending controls at the source

Issue role-based corporate cards with pre-set limits, vendor restrictions, and approval workflows. This prevents unplanned outflows and creates immediate visibility of where cash is going.

Using automated spend platforms like Alaan can help gain real-time insight into every transaction, making it easier to detect overspending before it impacts the runway.

2. Strengthen procurement discipline

Review vendor contracts regularly, consolidate overlapping subscriptions, and renegotiate terms. Procurement-led savings often reduce gross burn without affecting growth.

3. Align expenses with business priorities

Classify spending by strategic vs non-strategic categories. Protect investment in growth drivers (sales, product development) while trimming discretionary or duplicated costs.

4. Use dynamic scenario planning

Model different burn scenarios based on revenue assumptions, funding cycles, or market slowdowns. This allows CXOs and CFOs to stress-test runway and take early corrective action.

5. Automate compliance and reporting

Manual reconciliation and VAT checks add hidden costs. AI-powered automation ensures compliance while freeing finance teams to focus on decision-making instead of administration.

By pulling these levers consistently, burn rate becomes more than a backward-looking metric. It turns into a forward-looking tool that helps leadership maintain control and extend runway.

Also Read: Cash Flow from Operating Activities Explained: A Practical Guide for UAE Finance Teams

The Hidden Risks Behind a Rising Burn Rate

A high burn rate is not always bad. Growth periods often demand heavy investment. The problem begins when spending rises faster than the returns it generates. At that point, burn turns from a growth tool into a warning sign.

Here’s what typically follows when burn stays high for too long:

A high burn rate not only drains cash but also reduces strategic options. Businesses that monitor it closely can adjust early by managing vendors, tightening budgets, or improving collections, before liquidity pressure escalates. Understand how to achieve that below.

Reducing Burn Without Slowing Growth

Reducing burn rate is not about cutting costs across the board. It’s about spending with precision. The goal is to protect what drives growth and trim what quietly drains cash flow.

Here are practical ways to reduce burn while maintaining momentum:

1. Prioritise Growth-Linked Spending

Keep budgets focused on functions that drive revenue, such as sales, customer acquisition, and product development. Reducing investment in these areas can slow growth and increase burn in the long run by weakening future inflows.

2. Review and Consolidate Vendors

Audit all recurring payments and subscriptions. Identify duplicate tools, low-use software, or overlapping vendor services. Renegotiating terms or consolidating suppliers can lower costs without affecting productivity or performance.

3. Automate Recurring Finance Tasks

Automating expense reconciliation, VAT checks, and receipt validation cuts hidden manual costs and reduces errors that lead to rework. Automation also gives finance teams more time to analyse data instead of processing it.

4. Optimise Headcount Efficiency

Balance hiring plans with actual workload. Use temporary or project-based contracts when full-time roles aren’t critical. This approach keeps teams flexible and ensures that payroll growth aligns with business performance.

5. Plan for Different Revenue Scenarios

Model best- and worst-case projections for revenue and collections. Scenario planning helps identify when to pull back or when to accelerate spending, giving leadership enough time to correct course before liquidity becomes a concern.

When burn rate reduction is achieved through control and automation, it strengthens resilience without stalling growth.

How Finance Teams Operationalise Burn Control

Burn rate becomes valuable only when it is embedded into daily financial management. The strongest finance teams do not calculate it once a month; they track and interpret it continuously, using real-time data to guide spending and planning decisions.

Here’s how they make it work in practice:

1. Make Burn Visible in Dashboards

Create a live view of net burn, burn multiple, and runway inside finance dashboards. When leaders can see cash trends as they develop, decisions about hiring, marketing, or procurement become grounded in data instead of assumptions.

2. Assign Ownership and Review Cadence

Decide who monitors burn and how often. Some companies track it weekly; others link it to project milestones. Assigning ownership, typically within finance or FP&A, ensures accountability and consistency in reporting.

3. Integrate Data Across Systems

Link expense management tools, corporate cards, and ERP systems so that every transaction updates automatically.

This removes delays caused by manual reconciliation and keeps burn data current throughout the month, not just at closing.

4. Automate Checks for Compliance and Accuracy

Automated receipt matching, VAT validation, and duplicate detection prevent reporting gaps.

This improves audit readiness and avoids financial distortions that can misstate burn figures.

5. Run Regular Scenario Reviews

Review how burn changes under different assumptions, slower collections, higher hiring, or unexpected costs.

These reviews give leadership an early warning system and help them plan adjustments before cash pressure builds.

When burn control becomes part of everyday finance, decisions move faster, reporting stays accurate, and funding discussions become easier.

How to Start Embedding Burn Monitoring at Your Firm

Embedding burn monitoring is less about new calculations and more about building visibility and control into everyday finance operations. Leaders can start by focusing on five practical steps:

1. Make burn visible in dashboards

Real-time data is the foundation of effective burn control.

With Alaan, every expense made on a corporate card is recorded instantly and visible in a central dashboard. CFOs and finance teams can monitor net burn, runway, and cost categories as they happen, not weeks later.

2. Control spend at the source

Use role-based corporate cards with spend limits, vendor restrictions, and approval flows to stop leakage before it occurs.

3. Integrate with accounting and ERP systems

Ensure every expense flows directly into your ERP or accounting platform to keep books current and reduce reconciliation work.

4. Automate compliance checks

Use AI-driven automation to validate receipts, extract VAT data, and flag missing documentation. This reduces audit risk while saving time.

5. Run regular scenario planning

Model different burn outcomes, such as revenue shortfalls or cost increases, so teams can adjust strategy early, not under pressure.

Embedding burn monitoring is complex if done manually. With Alaan, it becomes a seamless part of how your company spends, tracks, and reconciles expenses every day. You can see where every dirham goes, ensure compliance automatically, and make funding and scaling decisions with full confidence in their numbers.

[cta-5]

Conclusion

Cash burn is more than a financial ratio, it is a reflection of financial discipline and leadership credibility. For CFOs, controllers, and CXOs, the challenge is not calculating burn, but ensuring that every transaction is visible, compliant, and aligned with strategy.

This is exactly what we solve at Alaan. Our platform issues corporate cards with built-in controls, automates receipt matching and VAT compliance, and integrates directly with ERP and accounting systems. The result: finance leaders gain real-time visibility into spending, reduce manual reconciliation, and make burn a live, controlled metric instead of a delayed report.

If your finance team is spending hours reconciling expenses and chasing receipts just to understand burn, Alaan can help.

Explore how our corporate cards and AI-powered platform bring spend under control and give you the visibility to extend the runway confidently. Schedule a free demo today.

Frequently Asked Questions

1. Is cash burn rate the same as operating expenses?

No. Operating expenses cover all recurring business costs such as rent, salaries, and utilities, but cash burn rate specifically measures the net reduction of cash each month after accounting for both expenses and inflows. A company can have high operating expenses but a lower burn rate if it also generates strong revenue.

2. How often should startups track their burn rate?

While many companies review burn monthly, high-growth startups and firms in volatile markets benefit from tracking it weekly or even daily. Frequent tracking helps detect sudden spikes in spending or cash leakage before they become major risks.

3. Can a profitable company still have a high burn rate?

Yes. A company might be profitable on paper but still face a high burn rate if cash is tied up in receivables, growth investments, or delayed revenue collection. That’s why burn is tracked alongside profitability; it reflects actual liquidity pressure.

4. What’s the difference between burn rate and churn rate?

Burn rate measures how quickly a company spends cash. Churn rate, common in SaaS, measures the percentage of customers or revenue lost over time. Both impact runway: high churn increases burn indirectly because customer losses reduce inflows.

5. How do investors use burn rate in funding decisions?

Investors view burn rate as a signal of capital efficiency. If a startup burns cash too quickly without corresponding revenue growth, it raises red flags about sustainability. A healthy burn multiple (typically 1–1.5) reassures investors that each dollar spent drives meaningful growth.

.avif)