Fuel spend is one of the most inconsistently managed cost categories in UAE organisations. Even businesses with well-defined travel procedures often struggle with incomplete documentation, uneven spending patterns across teams, and ambiguity about what qualifies as business fuel usage. These issues grow quickly in companies with sales vehicles, operational fleets, or field teams.

Without a clear policy, finance teams face challenges such as unverified fuel claims, missing VAT-compliant invoices, personal fuel usage disguised as business spend, and inconsistent reimbursement practices. A company vehicle fuel policy removes ambiguity by defining how fuel should be purchased, what documentation is required, and how usage will be monitored.

In this blog, we’ll outline the essential elements of a company vehicle fuel policy, the VAT and compliance considerations specific to the UAE, and the fuel payment methods businesses commonly use.

Key Takeaways

- A clear company vehicle fuel policy prevents misuse, supports VAT compliance, and creates consistent rules for all employees.

- Businesses should define eligibility, documentation requirements, spend limits, and prohibited usage.

- UAE tax considerations, especially VAT recovery rules, need to be built into the policy.

- Effective implementation requires communication, monitoring, and regular updates.

What a Company Vehicle Fuel Policy Should Cover

A fuel policy needs to be straightforward enough for employees to follow, but detailed enough for finance and operations teams to enforce consistently. At a minimum, it should define who can refuel company vehicles, how payments should be made, and what documentation is required.

1. Fuel Spend Eligibility

The policy should define what constitutes business travel for fuel expense purposes. This typically includes activities such as client visits, operational routes, site inspections, or inter-branch travel.

Personal trips should never be classified as business usage, even if the employee is driving a company-issued vehicle.

2. Employee Responsibilities

Employees using company vehicles should be responsible for:

- Refuelling only approved vehicles

- Submitting valid VAT invoices with TRN and fuel details

- Reporting irregular fuel consumption

- Ensuring vehicles are not refuelled for personal use

Clear responsibilities reduce disputes and improve compliance.

3. Manager and Finance Responsibilities

Managers should verify the business relevance of travel, while finance teams are responsible for:

- Reviewing receipts and validating VAT compliance

- Checking that fuel transactions match policy limits

- Monitoring patterns of unusual consumption

- Flagging exceptions and repeated non-compliance

4. Fuel Payment Methods

Companies should specify whether fuel is paid through corporate fuel cards, corporate payment cards, reimbursements, or fixed allowances. Each method carries different control requirements, so clarity helps maintain consistent governance.

The policy should also outline restrictions, for example, no premium fuel unless specified, no fuel for non-company vehicles, and no shared cards.

[cta-1]

Also read: 8 Steps for Effective Employee Expense Management in the UAE

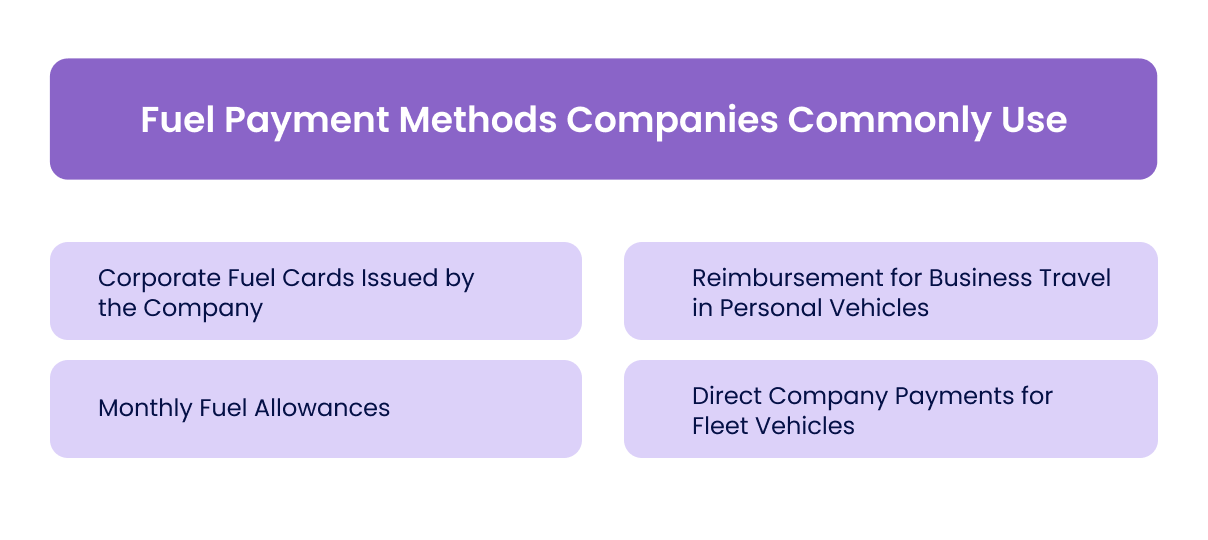

Fuel Payment Methods Companies Commonly Use

Companies in the UAE typically rely on one or a combination of the following approaches. The choice often depends on fleet size, cost structure, and internal control requirements.

1. Corporate Fuel Cards Issued by the Company

Fuel cards from ADNOC, ENOC, or EPPCO are common for operational fleets. They allow organisations to control fuel spend by setting limits, restricting stations, and linking cards to specific vehicles. They reduce misuse but require continuous oversight from finance.

2. Reimbursement for Business Travel in Personal Vehicles

Some organisations ask employees to refuel their personal vehicles and submit VAT-compliant invoices. This approach requires:

- Clear per-kilometre reimbursement rates

- Odometer records or trip logs

- Verification of business purpose

It is suitable for roles requiring occasional travel.

3. Monthly Fuel Allowances

A fixed allowance is simple to administer but carries a higher misuse risk. Employees may consume less fuel than the allowance amount, leading to additional taxable benefits or unnecessary spending.

Finance teams must evaluate whether the allowance aligns with actual business needs and whether it qualifies as a deductible expense under UAE tax rules.

4. Direct Company Payments for Fleet Vehicles

Fleet-intensive businesses like logistics, delivery services, and maintenance operations typically centralise payments. Fuel is billed to the company directly, and usage is monitored through telematics or route management systems.

Also read: Best Corporate Cards in the UAE

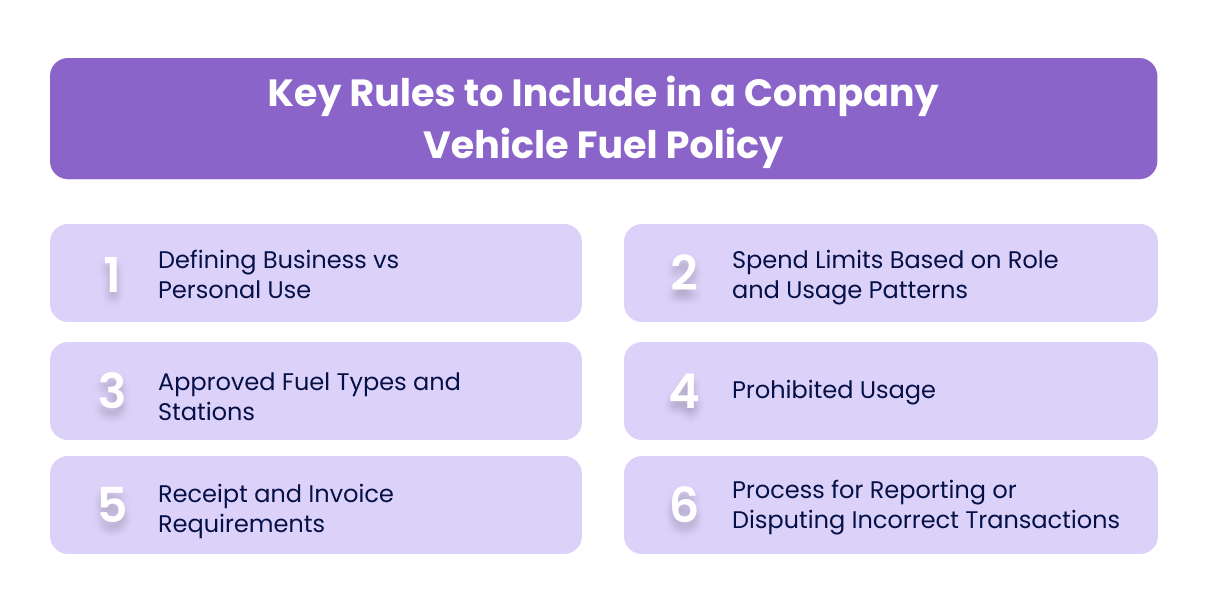

Key Rules to Include in a Company Vehicle Fuel Policy

A good fuel policy removes ambiguity. It sets clear expectations for employees and gives managers and finance teams the structure they need to maintain control across all vehicle-related spending.

1. Defining Business vs Personal Use

This distinction needs to be explicit. The policy should state clearly which activities qualify as business travel and how personal mileage is treated. Without this clarity, employees may unintentionally claim non-business fuel.

2. Spend Limits Based on Role and Usage Patterns

Roles that involve daily travel (sales, operations, logistics) should have defined monthly or weekly limits, based on:

- Expected route patterns

- Standard mileage or trip frequency

- Fuel efficiency of assigned vehicles

These limits create a benchmark to identify outliers or unusual spending.

3. Approved Fuel Types and Stations

If the company requires the use of standard-grade fuel or approved fuel stations, the policy should outline these requirements. This prevents unnecessary costs and ensures supporting documentation remains consistent.

4. Prohibited Usage

The policy should explicitly prohibit fuel purchases for non-company vehicles, personal errands, family members, or any non-business purpose. Stating these restrictions reduces ambiguity and helps finance enforce compliance fairly.

5. Receipt and Invoice Requirements

VAT recovery and accounting accuracy depend on proper documentation. The policy should require:

- VAT invoices with TRN

- Clear date, fuel quantity, and price

- Vehicle identification details (if applicable)

- Immediate submission through approved channels

Companies should also specify the consequences of missing receipts, such as delayed reimbursement or non-reimbursable claims.

6. Process for Reporting or Disputing Incorrect Transactions

Employees should understand how to report incorrect charges, suspected misuse, or anomalies in fuel consumption. Having a defined process ensures issues are resolved quickly and transparently.

Also read: VAT Compliance Health Check

Fuel Policy Considerations for UAE Tax and Compliance

Fuel expenses intersect with both VAT requirements and corporate tax treatment. A policy that aligns with UAE tax rules reduces the risk of disallowed deductions or audit challenges.

VAT Recovery Rules for Fuel Expenses

VAT on fuel is recoverable only when the fuel is used for business purposes and supported by a valid VAT invoice. Mixed-use vehicles may require allocation between business and personal usage. Fleet vehicles usually qualify for VAT recovery, but proper documentation remains essential.

Evidence Requirements for Company Vehicle Fuel

For VAT and corporate tax compliance, companies should maintain:

- VAT-compliant invoices

- Vehicle logs or telematics data (for high-volume fleets)

- Odometer readings at defined intervals

- Driver and vehicle assignment records

This helps justify business relevance during an audit.

Fuel Benefits and Allowances Under UAE Corporate Tax

Fuel allowances provided as part of employee compensation are treated differently from reimbursed business fuel. Finance teams should distinguish:

- Allowances (employee benefit, not a business expense deduction)

- Reimbursed actual fuel spend (deductible if business-related)

This distinction matters for corporate tax reporting.

Treatment of Mixed Personal and Business Use

Where a vehicle is used for both purposes, companies should:

- Define an allocation method (e.g., mileage split)

- Apply it consistently

- Maintain documentation supporting the basis

This avoids disallowed expenses and disputes during tax reviews.

Also read: Understanding Business Expenses in the UAE

How to Implement and Enforce a Fuel Policy in Your Organisation

A fuel policy only works when supported by clear communication, structured monitoring, and regular updates. The goal is to ensure consistency across departments, minimise misuse, and maintain accurate documentation for accounting and VAT compliance.

1. Setting Department-Level Guidelines

Different teams consume fuel at different rates. Sales teams may cover varied client routes, while logistics or field services follow fixed operational patterns.

Your policy should reflect these differences by setting realistic guidelines based on vehicle type, job function, and typical monthly distances. This ensures that spending expectations are aligned with actual operational needs.

2. Communicating the Policy to Employees

Policy adoption depends on clear communication. New employees should receive fuel policy training during onboarding, and existing staff should have access to updated guidelines through internal platforms.

Requiring employees to acknowledge the policy formally helps reinforce compliance and reduces misunderstandings later.

3. Monitoring Usage and Detecting Exceptions

Regular monitoring is essential, especially in organisations with high fuel volume. Finance or fleet teams should look for patterns that fall outside normal usage, unusually high volumes, refuelling in areas unrelated to the employee’s route, multiple transactions in short intervals, or receipts that do not match the assigned vehicle.

Early identification of these exceptions prevents repeated misuse and supports timely corrective action.

4. Reviewing and Updating the Policy Regularly

Fuel prices fluctuate, travel patterns shift, and UAE VAT rules evolve. Because of this, fuel policies should be reviewed at least annually. They may need earlier updates if the business adds new vehicle types, introduces new travel routes, or identifies recurring issues in fuel spend.

Regular updates keep the policy relevant, enforceable, and aligned with the organisation’s financial and compliance requirements.

Also read: Effective Business Spending Policies

How Alaan Helps Companies Manage Fuel Spend Accurately

Alaan gives finance teams the structure and real-time visibility they need to manage fuel spend without relying on manual checks or inconsistent receipts. Instead of reviewing claims days or weeks after the expense occurs, companies see every fuel transaction as it happens, with correct coding, documentation, and policy validation already in place.

Real-Time Tracking of Fuel Transactions Using Corporate Cards

With Alaan, employees simply use their corporate cards to pay for fuel. Each transaction appears immediately on the platform, enabling finance teams to monitor usage, identify unusual spending patterns, and ensure compliance with assigned limits. This removes guesswork and strengthens control over fuel-related costs.

Spend Controls to Restrict Unapproved Fuel Purchases

Finance teams can set rules that automatically enforce the policy. Controls may include:

- Merchant category restrictions

- Spend limits by role or department

- Usage rules for approved fuel stations

- Blocking transactions outside working hours (if required)

These controls reduce misuse and prevent non-business expenses from reaching the accounting system.

Automated Receipt Capture and VAT Validation

Once fuel is purchased, employees upload receipts through the Alaan app or Chrome extension. Alaan Intelligence extracts VAT details, checks TRN validity, and ensures invoices contain the required information. Missing or non-compliant receipts are flagged early, preventing VAT recovery issues during filing.

ERP Sync for Accurate Fuel Expense Classification

Alaan integrates with Xero, QuickBooks, NetSuite, and Microsoft Dynamics. Each transaction is synced with the correct expense category, tax code, and cost centre. This eliminates manual entry and ensures fuel expenses are classified consistently across the organisation.

Full Audit Trails for Every Fuel Transaction

Each fuel transaction carries a digital trail showing who spent, what was purchased, the receipt, VAT details, approvals, and comments. This strengthens audit readiness and helps companies respond confidently to internal or external reviews.

[cta-11]

Conclusion

A company vehicle fuel policy strengthens both financial control and operational clarity. It gives employees a clear understanding of what qualifies as business fuel usage, and it provides finance teams with a consistent framework for reviewing, documenting, and approving fuel-related spend. When supported with tools that offer real-time data, automated documentation, and clear controls, the policy becomes far easier to enforce and far more effective.

In a market where fuel prices, travel patterns, and regulatory requirements continue to evolve, a structured policy is no longer optional. It is an essential component of responsible spend management and long-term cost discipline.

At Alaan, we help UAE businesses manage fuel spend with real-time tracking, receipt verification, VAT checks, and ERP syncing, ensuring your fuel policy is easy to enforce and financially accurate.

If you want tighter control over vehicle-related expenses, you can book a demo and see how Alaan streamlines fuel spending across teams and locations.

Frequently Asked Questions (FAQs)

1. What should a company vehicle fuel policy include?

It should define business fuel usage, payment methods, documentation requirements, spend limit, and prohibited activities. It should also explain how transactions will be reviewed and monitored.

2. Are fuel expenses always deductible for UAE businesses?

Fuel is deductible only when used for business purposes and supported by proper VAT invoices. Mixed personal and business use may require allocation.

3. What documents do employees need to submit for fuel reimbursement?

A valid VAT invoice with TRN, date, fuel quantity, and price. Some companies also require odometer readings or trip logs for certain roles.

4. How can companies prevent misuse of fuel cards?

By setting spend limits, restricting merchant categories, linking cards to specific vehicles, and monitoring consumption regularly. Automated controls significantly reduce misuse.

5. Should fuel allowances be part of a fuel policy?

Yes. Allowances should be addressed separately, as they are treated differently from reimbursed business expenses and may not qualify as tax-deductible.

6. How does Alaan support fuel policy enforcement?

Alaan provides real-time tracking, spend controls, receipt capture, VAT validation, and ERP syncing, ensuring every fuel transaction is compliant and correctly classified.

.avif)