As a business operating in the UAE, it is important to stay updated with the latest corporate tax rules and how they affect your operations. This helps ensure compliance with the Federal Tax Authority (FTA) and makes informed financial decisions.

At Alaan, we know that understanding different aspects of corporate tax in the UAE can be complex and often confusing. That is why we are putting together a detailed article to answer your many questions.

What is the corporate tax in the UAE?

Corporate tax in the UAE is an indirect tax applicable to the net profits of companies operating within the country. Ministry of Finance introduced this tax on 31 January 2022.

The UAE Corporate Tax became applicable either on 1 June 2023 or on 1 January 2024, depending on the financial year followed by the business. As per the rules specified by the FTA, if you are a business operating in the UAE and meet the eligibility for corporate tax, you need to pay a certain percentage of your profit as tax.

The standard corporate tax rate in the UAE is 9% for taxable income exceeding AED 375,000. However, to support small businesses and startups, the tax rate is 0% if the net profit is up to AED 375,000.

UAE corporate tax exemptions

The UAE corporate tax rules apply to most businesses in the country, but there are specific income streams that are exempt from this tax. These exemptions can reduce the compliance burden for businesses, as they are not required to pay corporate tax on these transactions. Here are some of the exemptions specified by the Ministry of Finance:

- Dividend income earned by the UAE company from its qualifying shareholdings.

- Capital gains from selling shares or long-term assets in your company.

- Profits from group reorganisation like mergers, acquisitions, and internal restructuring.

- Profits from Intra-group transactions conducted at arm's length (Fair Market Value).

Free Zone entities and branches

Free Zone entities may be eligible for a 0% corporate tax rate depending on factors like minimum investment, business activity type, or maintaining a physical presence within the zone.

However, branches of foreign entities in the UAE are generally considered taxpayers for corporate tax purposes. They might be subject to the standard 9% corporate tax rate on mainland-generated profits.

If the branch only performs supporting activities for the head office functions and does not generate independent income within the mainland, it might be exempt from the corporate tax.

What is the corporate tax rate in the UAE?

In the UAE, the corporate tax rate is applicable as per the following slabs:

- In case your company's taxable income exceeds AED 375,000, you will be subject to 9% corporate tax.

- In case your taxable income is below AED 375,000, your company will be eligible for a 0% tax rate.

The UAE’s tiered corporate tax structure is designed to support smaller businesses or startups. If your business earns up to AED 375,000, you can enjoy a 0% tax rate on these earnings. For instance, let’s consider that your business has a taxable income of AED 500,000. In this case, 9% corporate tax will be applicable only on AED 125,000, the amount exceeding the AED 375,000 threshold. This structure provides financial flexibility, fostering growth and sustainability for your business.

Who needs to register for UAE corporate tax?

All businesses operating in the UAE must complete their corporate tax registration. This includes companies in the Free Zone, mainland UAE, and multinational corporations subject to OECD Base Erosion and Profit-Sharing laws under Pillar 2 of the BEPS 2.0 framework. This requirement applies regardless of whether they are subject to a 0% or 9% corporate tax rate.

What is the first corporate tax year for a UAE Company?

The first corporate tax year is the first financial year for which your company is liable to pay corporate tax. It aligns with your company’s financial year, a 12-month period for which you prepare your company’s accounts.

- If your company's financial year starts on 1st July 2023 and concludes on 30th June 2024, your first corporate tax year would be from 1st July 2023 to 30th June 2024.

- If your financial year begins on 1st January 2023 and ends on 31st December 2023, you will be liable for UAE CT from 1st January 2024. Hence, your first corporate tax year would be from 1st January 2024 to 31st December 2024.

How does corporate tax apply to Free Zone companies?

If you are a Free Zone company in the UAE, then you can benefit from a preferential corporate tax regime. However, you must meet certain conditions to be considered a Qualifying Free Zone Person (QFZP). As a QFZP, your Free Zone company may be eligible for a 0% corporate tax rate on income from eligible activities and transactions.

To be considered a QFZP and enjoy the 0% corporate tax rate, you must satisfy the following conditions:

- Maintain adequate substance (substantial presence) in the Free Zone where your company is established. This implies that your main business activities should be conducted from and resources must be physically located within the Free Zone.

- Derive income from qualifying activities as defined by the regulations.

- Should not have opted for the regular UAE CT regime.

- Comply with the arm's length principle, transfer pricing rules and documentation requirements.

If your Free Zone company fails to meet any of these conditions, you may lose the QFZP status and become subject to the standard 9% corporate tax rate on the taxable income.

What is exempt from corporate tax in UAE?

In the UAE, certain supplies and businesses are exempt from corporate tax, providing some relief to specific sectors and activities. Here is a detailed look at what is exempt from corporate tax in the UAE:

- Qualifying businesses: Businesses with an annual income below AED 375,000 are exempt from federal corporate tax, effectively enjoying a 0% tax rate.

- Government entities: The UAE government departments, authorities, and other public institutions are typically exempt from corporate tax.

- Wholly-owned government companies: Companies that are wholly owned and controlled by the UAE government and carry out specific activities are also exempt from corporate tax.

- Qualifying public benefit entities: Organisations established for the public good, such as charities, non-profits, and educational institutions, may be exempt from the UAE corporate tax.

- Investment funds and public pension and social security funds: Certain investment funds, including regulated mutual funds and alternative investment funds, can be exempt from corporate tax in the UAE.

- Free Zone businesses: Businesses operating in designated Free Zones might be exempt from corporate tax, provided they meet the specified conditions and comply with the FTA guidelines.

- Natural resource extraction: Companies involved in the exploitation or extraction of natural resources, like oil and gas, are exempt from the UAE corporate tax.

What is the difference between a Qualified Free Zone Person (QFZP) and a non-qualified one in terms of corporate tax?

Regarding corporate tax in the UAE, the distinction between a QFZP and a non-QFZP lies in the tax benefits and obligations applicable to each type of entity.

A 'Qualifying Free Zone Person' refers to a Free Zone entity that meets specific conditions set out in the UAE Corporate Tax Law. As a QFZP, your business may be eligible for a 0% corporate tax rate on income from qualifying transactions and activities with other Free Zone persons.

Even if your Free Zone business has some non-qualifying income, the business may still be considered a QFZP if the income is below the De Minimis Threshold. This is the maximum non-qualifying income you can generate (AED 5 million or 5% of total revenue) while still maintaining the QFZP status.

On the other hand, a 'Non-Qualifying Free Zone Person' refers to a Free Zone entity that does not meet the criteria to be considered a QFZP. This could be due to various reasons, such as engaging in non-qualifying activities, failing to maintain adequate substance, not following the arm's length principle with related parties, and several others.

As a Non-Qualifying Free Zone Person, your business may be subject to the standard 9% corporate tax rate on its taxable income, similar to mainland UAE companies.

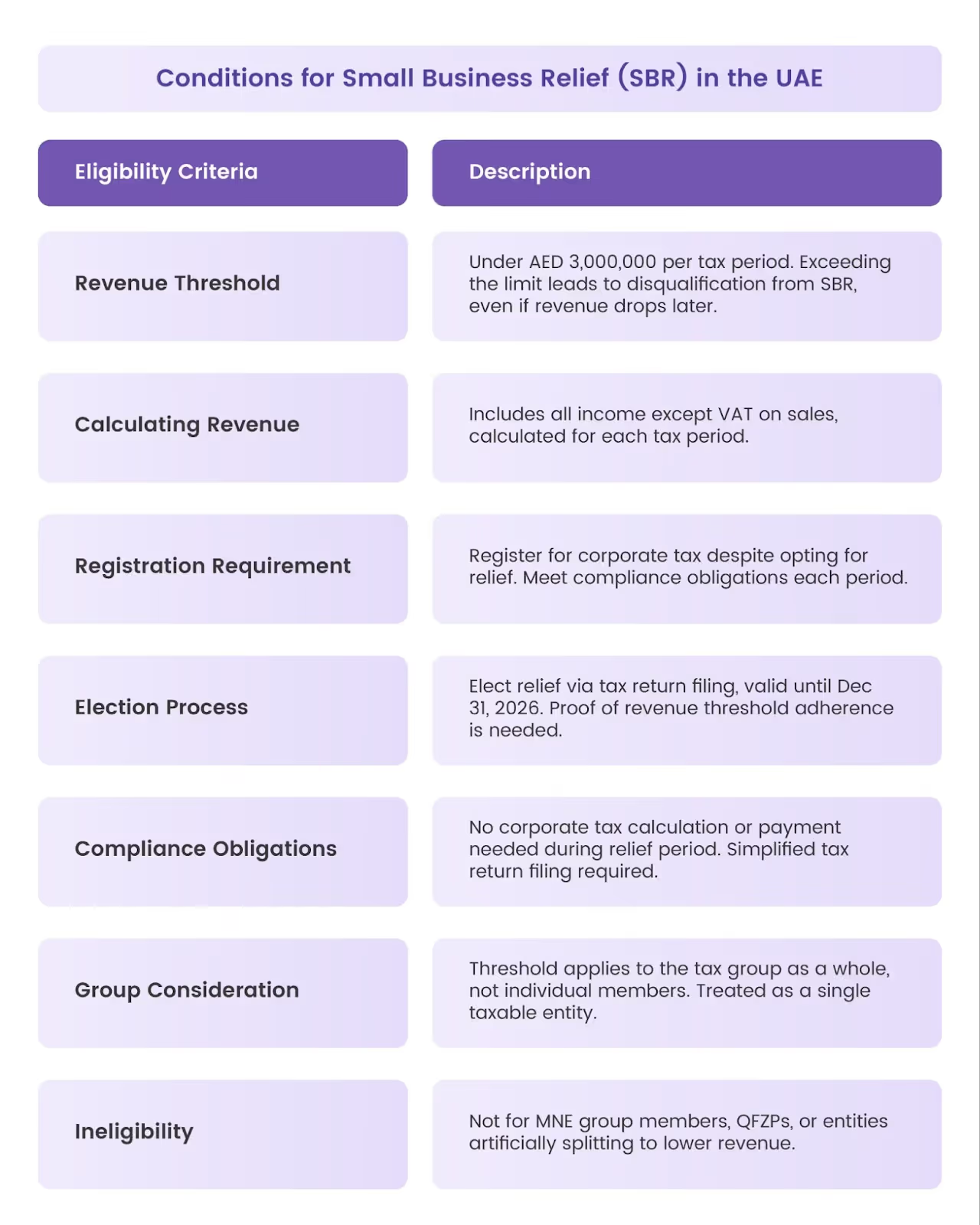

Who can claim Small Business Relief (SBR) in the UAE?

If your company has a turnover of less than AED 3 million, you may be eligible to claim Small Business Relief (SBR) in the UAE. By claiming SBR, you can enjoy simplified compliance and reduced documentation requirements. You may also be eligible for lower corporate tax rates or exemptions from certain tax obligations.

To claim SBR, you must meet the following criteria:

- Be a resident person for Corporate Tax purposes in the UAE.

- Have a Revenue of less than or equal to AED 3,000,000 in the relevant Tax Period and all previous Tax Periods.

- Not be a member of a Multinational Enterprise (MNE) group or a QFZP.

- Even if your business has some non-qualifying income, you may still be eligible for SBR if the non-qualifying revenue remains below AED 3 million.

There's no separate application process for SBR. You must complete your corporate tax registration process and obtain a Tax Registration Number (TRN). You will have to opt for SBR benefits while filing your corporate tax return for the relevant tax period. The election must be made for each tax period during which a tax return is filed.

How does corporate tax apply to natural persons conducting business in the UAE?

Under the UAE Corporate Tax Law, a 'natural person' refers to any living human being, including minors and incapacitated individuals represented by legal representatives. As a natural person conducting business in the UAE, you will be considered a 'taxable person' for corporate tax purposes if your total turnover from business activities exceeds AED 1 million within a Gregorian calendar year (1st January to 31st December).

This includes natural persons with a permanent establishment in the UAE or those deriving UAE-sourced income from their business activities. Your income from wages, personal investments, and real estate investments is not considered business income and is disregarded when determining your total turnover for corporate tax purposes.

To comply with the UAE corporate tax rules, you must complete the registration with FTA, submit annual corporate tax returns, and pay corporate tax, where applicable. The tax returns must be filed no later than nine months after the end of the relevant tax period.

Corporate tax rates for a natural person

As a natural person, corporate tax will apply to your taxable business as per the following guidelines:

- 0% on taxable income below AED 375,000

- 9% on the part of the taxable income that exceeds AED 375,000

Can a company set off losses against profits in the UAE?

Yes, your company can set off losses against profits, up to a maximum of 75%, subject to certain conditions and limitations. This provision allows you to offset your taxable income with losses incurred in previous years for tax relief. You can carry forward any excess tax losses indefinitely and use them against taxable income from future tax periods.

This benefit is subject to the following conditions:

- Losses can only be carried forward, not backwards. This means you can use your losses to reduce your taxable income in future years, but not in the year the loss was incurred or in previous years.

- Losses must be calculated in accordance with the Corporate Tax Law. This includes adjustments for non-deductible expenses, exempt income, and other provisions of the law.

- Losses can only be set off against profits from the same source. For example, losses from a business activity can only be set off against profits from the same business activity, not against profits from other sources like investments or real estate.

What are the compliance requirements for corporate tax in the UAE?

Here are the compliance requirements you must follow to meet your corporate tax obligations and operate within the legal framework:

- Corporate tax registration: Companies on the mainland and in Free Zones must register with the FTA for corporate tax.

- Filing tax returns: Once registered, you must file your corporate tax returns annually. As a registered business, the tax return must detail your financial information, income, expenses, deductions, and tax calculations.

- Maintaining financial statements: You must keep detailed records of your financial transactions, income, expenses, assets, and liabilities to support tax calculations and filings.

- Transfer pricing documentation: This documentation ensures that transactions are conducted at arm's length, comply with the UAE corporate tax law, and do not result in tax avoidance or profit shifting.

- Record preservation: You must preserve the financial records, accounting documents, tax returns, and other relevant information for up to 7 years. This requirement ensures that you have all necessary documentation available for any future audits or inquiries by the FTA.

What supporting documents are required for corporate tax filing in the UAE?

Here is a breakdown of the key documents you should consider keeping:

- Invoices: Ensure all sales and purchase invoices are systematically detailed and stored. This can help you accurately report your taxable income and claim allowable deductions.

- Agreements and contracts: These documents can provide evidence of the terms and conditions of your business transactions. This can be vital during audits to establish the legitimacy and context of your expenses and revenues.

- Financial statements: Maintain comprehensive financial statements, including profit and loss statements, balance sheets, and cash flow statements, for a detailed overview of your financial activities.

- Bank statements: Keeping these statements assists in verifying the income and expenses mentioned on the tax returns and ensures transparency in financial dealings.

- Payroll records: These records should include salary payments, bonuses, and any other employee-related expenses to support your expense claims and ensure compliance with employment laws.

- Receipts and payment vouchers: These documents provide proof of the expenses incurred and can be crucial during an audit.

- Transfer pricing documentation: This documentation should demonstrate that these transactions are conducted at arm's length and comply with the UAE corporate tax law.

Are employee benefits deductible expenses for tax purposes?

Employee benefits that are directly related to your company and are incurred for the purpose of conducting business operations are considered legitimate business expenditures. This includes expenses like school fees for employees' children and family medical insurance, which contribute to the well-being and productivity of the workforce.

To ensure that employee benefits are deductible for tax purposes, maintain documentation to show the business purpose of these expenses, such as invoices, receipts, agreements, or other relevant records.

How can corporate tax liability for businesses in the UAE be reduced?

As a business operating in the UAE, you may be looking for ways to optimise your corporate tax liability and maximise your profits. Here are some strategies you can use to reduce your tax burden:

- Utilise tax incentives and exemptions: The UAE government offers various tax incentives and exemptions to promote economic growth and attract foreign investment. For instance, certain industries and sectors enjoy specific tax incentives, such as exemptions from corporate tax or reduced tax rates.

- Optimise your business structure: Your tax liability is also affected by the legal structure of your business. Consider whether your current structure is the most tax-efficient option. For example, if you have multiple businesses, you may be able to reduce your tax liability by forming a group structure.

- Leverage Double Taxation Avoidance Agreements (DTAAs): The UAE has signed DTAAs with several countries, aiming to avoid double taxation of income in both jurisdictions. By leveraging these agreements, you can benefit from reduced tax rates or exemptions on certain types of income.

- File returns on time: File the corporate tax returns and pay the tax amount before the due date to avoid late payment fines and penalties.

- Seek professional advice: While these strategies can help you reduce your corporate tax liability, it is crucial to seek professional advice from a qualified tax advisor or consultant. They can create custom strategies to meet your specific needs and ensure compliance.

If a company is a BVI Entity but conducts business activities within the UAE, is it eligible for corporate tax?

A company that is a BVI (British Virgin Islands) entity but conducts business activities within the UAE may be eligible for corporate tax in the UAE. However, for this, it must meet the following criteria:

- Have a permanent establishment (PE) in the UAE: The company must have a fixed place of business in the UAE through which its business is wholly or partly carried on.

- Derive UAE-sourced income: The company must derive income from its business activities conducted in the UAE.

- Meet the definition of a 'Taxable Person': The company must meet the definition of a 'Taxable Person' under the UAE Corporate Tax Law. This includes entities that are residents of the UAE or have a PE in the UAE.

Tax Implications

If a BVI entity meets the corporate tax eligibility criteria in the UAE, it must:

- Register for corporate tax with the Federal Tax Authority (FTA)

- File annual corporate tax returns and pay the applicable tax

- Maintain proper documentation to support its tax filings, such as financial statements and transfer pricing documentation.

The company will be subject to the standard corporate tax rate of 9% on its taxable income exceeding AED 375,000.

Conclusion

Corporate tax compliance involves several critical steps, including registration, maintaining accurate financial records, and filing timely tax returns. By familiarising yourself with these requirements and keeping organised documentation, you can achieve better compliance and focus on your business growth.

However, the 9% corporate tax can be an additional financial burden. Using an automated spend management platform, such as Alaan, could be one step towards efficient financial management and availing the following benefits:

- Correct expense identification: Alaan streamlines your financial processes, eliminating manual errors in expense categorisation and reporting. This ensures you claim all eligible deductions and avoid overpaying taxes.

- Optimise cash flow: Alaan can help identify areas of unnecessary spending within your business. By analysing your expenses, you can take corrective actions and prevent wasteful cash outflows.

Ready to take control of your expenses and expertly navigate the corporate tax landscape in the UAE? Get started with Alaan today.

.avif)